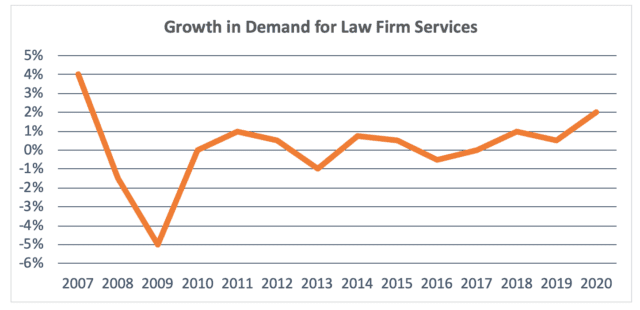

Heading into 2020, law firms found themselves well positioned following a strong 2019; demand climbed, revenue increased, and firms hired at a rate that outpaced the demand for legal services. For some firms, 2019 was the best year they’d had since the last economic downturn.

Based on the Peer Monitor report for Q1 ’20, this good fortune continued into the early months of this year. But by mid-March, when life was interrupted officially by the pandemic, demand for law firm legal services felt the impact. The first quarter ended overall optimistically at 2%; however, the response to demand in these unprecedented times is just beginning to rear its head.

Practice Demand Impact

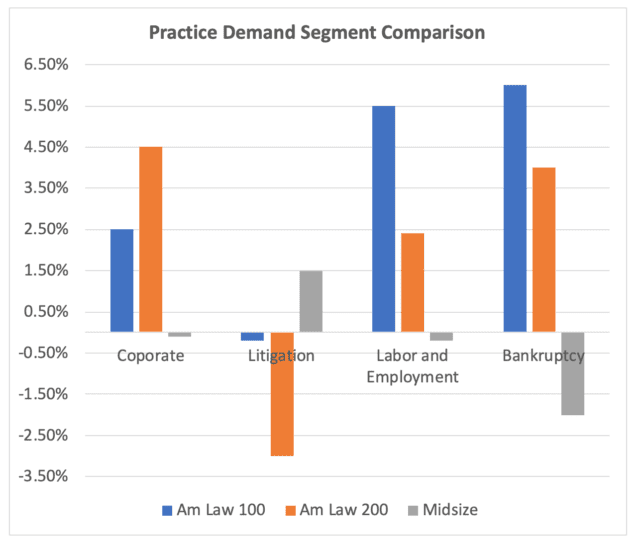

Reviewing the quarter, the economic slowdown began to impact legal demand by mid-March — a dip that many leaders predicted. Nearly 80% of law firm executives taking part in the Intapp COVID-19 Pulse Survey (respondents are law firm leaders, a majority of whom are within firms of 500 attorneys or more) believed that COVID-19 would have a significant negative impact on demand for legal services in the coming 6 months. The remaining 20% of those surveyed anticipated a rise in countercyclical practices like labor and employment, bankruptcy, and real estate — a trend that is indeed beginning to materialize, as seen in the Peer Monitor results.

Looking at March last year versus this year: Even with one extra working day in the month, the industry couldn’t postpone the inevitable: a decline in demand for legal services across all segments. Specifically, practices like litigation have decreased. According to Jim Jones, Director of the Program on Trends In Law Practice at Georgetown, the uptick in the midmarket comes as the result of work moving downstream as clients are asked to make more conscious decisions to avoid litigious work and seek lower-cost options. Meanwhile, practices like labor and employment and bankruptcy are growing for Am Law 200 firms.

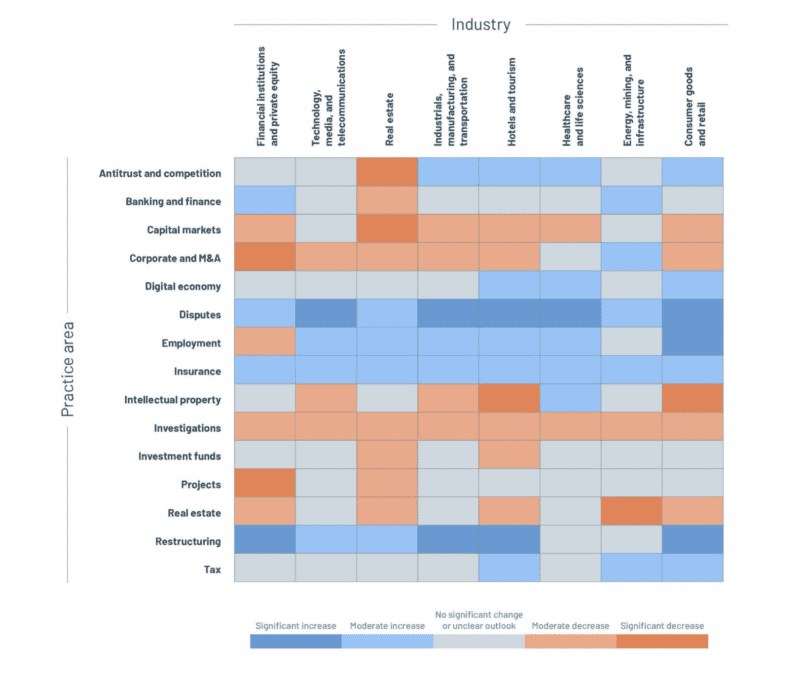

This offers just a glimpse of what is beginning to unfold within legal practices. A recent Intapp Strategic Consulting Brief, COVID-19: Business Impact on Law Firms, reveals that 94% of Fortune 1000 corporations have experienced disruptions related to COVID-19, suggesting the widespread impact is just beginning to affect firms. To gain a better understanding of what is to come, Intapp Strategic Consulting has developed a demand impact model, analyzing each industry and its ensuing implications on legal services.

Intapp demand impact model: 6-month outlook for legal services

As Q1 ’20 performance is beginning to show, the market will continue to see increases in demand for bankruptcy, restructuring, insolvency, and disputes across most industries, whereas transactional practices will see a decline. There will be areas of opportunity that show up as the landscape changes for certain industries. For example, the uptick in the healthcare and life sciences sector — with increased work in the fight against COVID-19 — will trickle to legal by way of regulatory changes as well as changes in business demand and its impacts on employment and supply chain.

Duration of Impact

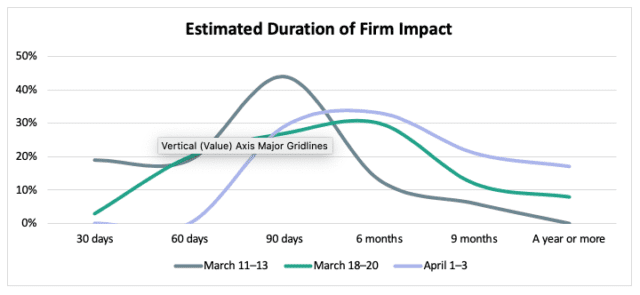

A growing majority of respondents to the Intapp COVID-19 Pulse Survey believe the pandemic will impact law firms for a 90-day to 6-month period. These findings align with Acritas’s reporting that in-house legal teams will be reducing expenses for the next 6 to 12 months, a hint of what’s to come in Q2. Taken together, these results suggest that industry insiders feel that the effects of the pandemic could be shorter lived than the last economic downturn.

Other factors at play differentiate these times from past cycles. Specifically, law firms are going into this period with steady, rather than declining, demand. January and February provided a strong start to the year — perhaps work was brought in early, in anticipation of the courts shutting down — providing better positioning for firms. Additionally, the disruption law firms felt coming out of the 2008–2009 recession, due to more sophisticated in-house counsel and the entrance of alternative legal service providers to the market, is now a reality that law firms have been competing against for nearly 10 years.

Impact on Firm Operations

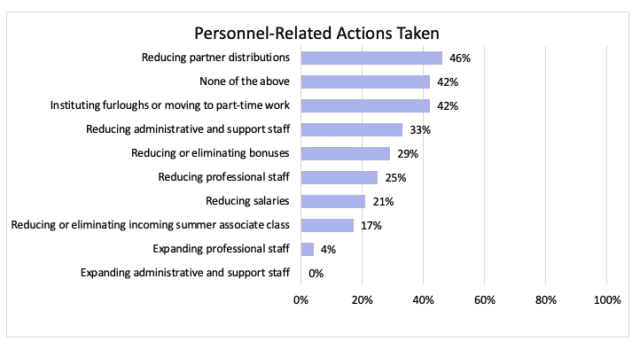

Prudent firms have taken note: by early April, 92% of respondents to Intapp COVID-19 Pulse Survey said their firms were reviewing or decreasing discretionary spending, and 75% said they were already reducing the overall budgets. Primarily, these decreases have come in the form of layoffs and furloughs; the latest stats show that the legal industry shed 64,000 jobs in April, accounting for reductions in professional staff, summer associates, and lawyers. Other personnel-related actions include a reduction of partner distributions reported by 46% of respondents, and the reduction or elimination of bonuses at 29% of respondents’ firms.

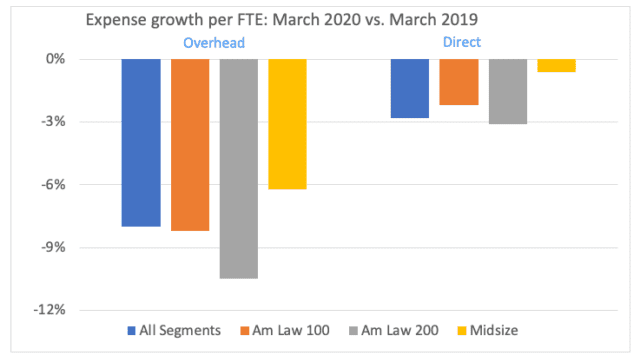

It’s not just lawyers and professionals impacted during this time. Both overhead and direct expenses saw declines in March, as firms began to configure a financial model that would secure their ability to continue to compete in the market.

All of these measured attempts by firms to adjust to the new reality and prepare for the unknown will play out over the next year. Carrying the lessons of the last recession, in times like this firms must nurture key-client relationships, plan and manage near-term business implications, and implement agile, clear, and forward-looking plans across the horizon. As other industries continue to respond to COVID, in a similar stroke, the firms that realign business to support productivity and differentiation will emerge better positioned within the post-COVID era.