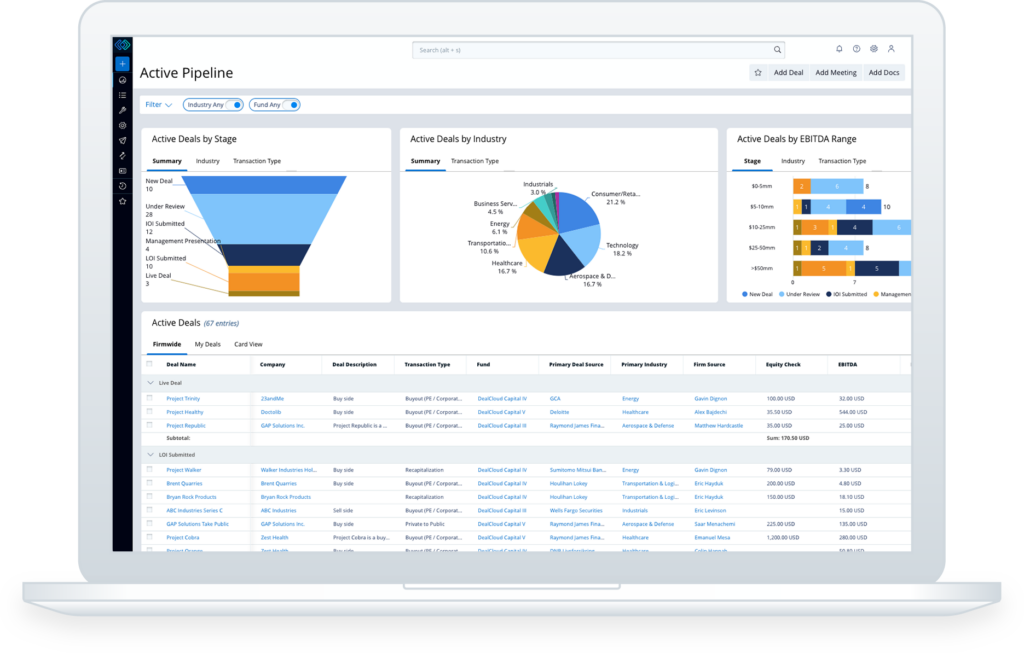

Boost win rates and increase operational efficiency with a platform built for dealmakers and professionals. From a single platform, build and maintain meaningful relationships, analyze market trends and active targets, and simplify deal execution. Find your most profitable opportunities and expedite your deal closures — all with Intapp DealCloud for private capital markets.