Boost your win rates and improve operational efficiency at your venture capital firm. With Intapp DealCloud, grow meaningful relationships, analyze market trends and discover best-fit investment opportunities, and optimize deal execution.

Venture capital software and solutions

DealCloud has transformed our organization far beyond operational improvements. The tool … replaces frustration with collaboration, and this continues to strengthen our corporate culture.

Our senior management has confidence in our streamlined decision-making process, which frees up time to grow our business.

Build valuable relationships with AI intelligence reporting, automated data capture, and pipeline coverage.

Streamline firm outreach with built-in tools to design, send, and analyze both campaigns and results.

Discover qualified opportunities by analyzing intermediary and founder relationships alongside market activity.

Maximize your resources, centralize your target pipeline, and improve decision-making .

Centralize your approval workflows and due diligence checklists from a single managed hub.

Using firm data, reduce delays and time lags in investor outreach, lead progression, and fund management.

Make firm knowledge more accessible for more informed decision-making.

Improve communication and inform decision-making with unified workflows and intelligence.

Learn more about your relationships with automated scoring and intelligence reporting that can inform future decisions.

Drive strategy and pipeline management with automated data capture, diligence workflows, and reports.

With AI summaries of deal information, save time on decisions using AI-generated recommendations from firm and market intelligence.

With Microsoft 365 and other third-party integrations,easily share data across your firm from a centralized hub.

Work on the go with your iOS or Android app to upload data, search and review details, and take notes offline, with automatic syncing when reconnected.

With increased competition in the market, keeping track of evolving trends, key relationships, and pipeline progress is more challenging than ever. To manage complex venture capital investment strategies, today’s firms require easily configurable technology built to suit their workflows. By creating a single source of truth for institutional data, Intapp DealCloud enables venture capital professionals to operate more efficiently and strategically.

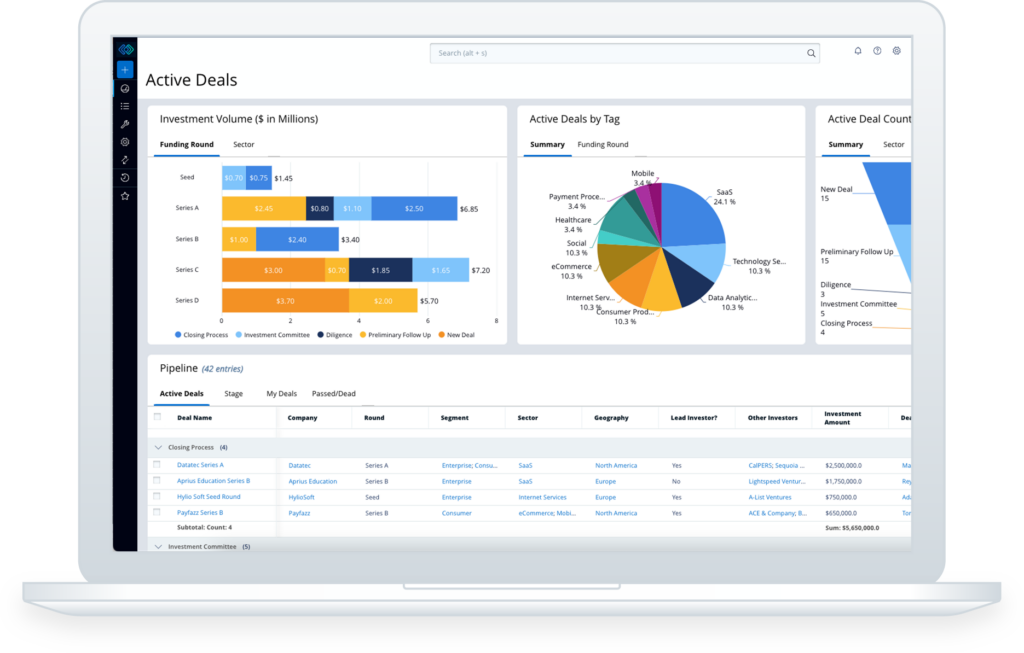

In a hypercompetitive funding landscape, venture capital firms need to maintain visibility on developments in their industries and track emerging trends. That’s why they leverage Intapp DealCloud to deploy capital more effectively in the following areas: deal and pipeline management, lender coverage, industry analysis, deal and workflow management, executive network management, business development and activity tracking, round-by-round funding analytics, and deal and legal document management.

Since our platform was built by industry experts, we know not all venture capital firms operate in the same way. The pipeline, relationship management, and reporting needs vary from firm and company to division and individual. That’s why our users can customize Intapp DealCloud on an individual user basis so that every user has the tools and the views in front of them necessary to facilitate the flow of information with the right levels of access. Customize every dashboard, chart, graph, tearsheet, data sheet, and profile to meet each dealmaker’s reporting and analytics preferences and interests.

Fill out the form and someone will be in touch to provide a demo.

For more than a decade, Intapp has been bringing the power of automation and intelligence to professional and financial services firms — helping clients like you solve their specialized needs and challenges.

The results of our technology strategy are the industry solutions professionals rely on to close deals, meet compliance, and increase visibility and collaboration.

Our AI solutions, built on Intapp Data Foundation, meet industry-specific data, integration, and security needs to support your professionals.

Learn more about our data foundationSecure your data with Intapp Cloud Infrastructure, leveraging Microsoft Azure’s stability and our dedicated support, plus seamless Microsoft integrations.

Learn more about our cloud infrastructureGain access to Intapp’s ecosystem of data, technology, and services from over 100 trusted partners, with built-in integrations and dedicated support.

Learn more about our partner ecosystem