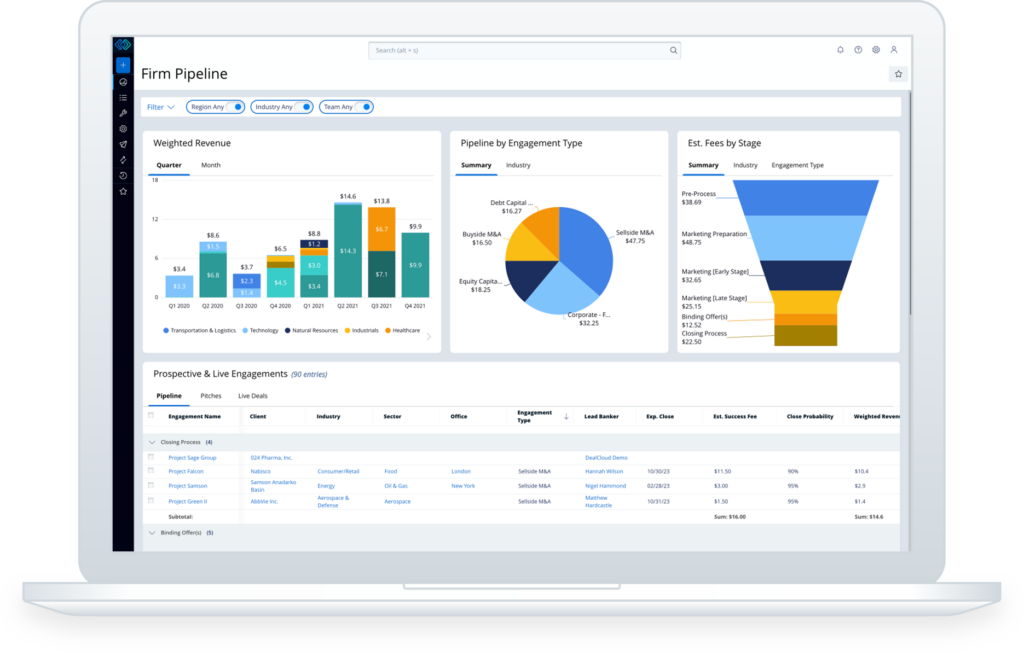

Boost win rates and increase operational efficiency with an all-in-one deal and relationship management solution.

Access the relationship intelligence, market trends, and actionable insights needed to build stronger relationships and accelerate deal execution — all with Intapp DealCloud for investment banking and advisory.