Take on more high-quality opportunities that align with your firm’s unique needs. Intapp has a proven track record of enabling investment banking and advisory firms to better manage risk, improve operational efficiencies, drive profitability, and enhance firmwide transparency.

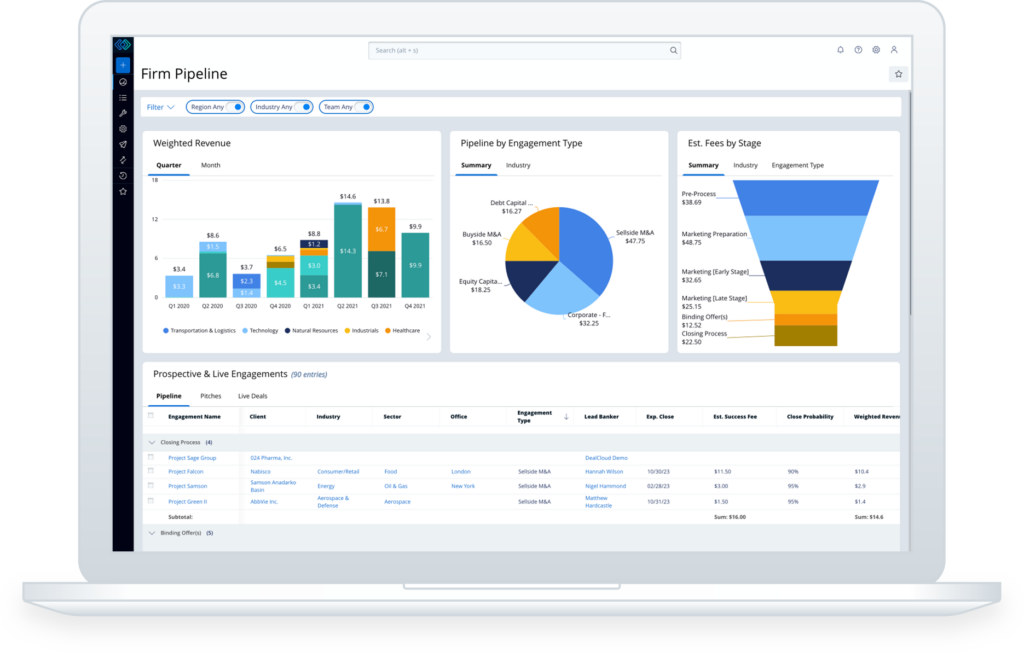

We provide a technological backbone to intermediary firms of all sizes, from regional and boutique firms to large multinational banks. Our fully configurable, unified technology platform acts as a central hub for relationship intelligence — so your investment banking teams can easily access information and make faster decisions around engagements.