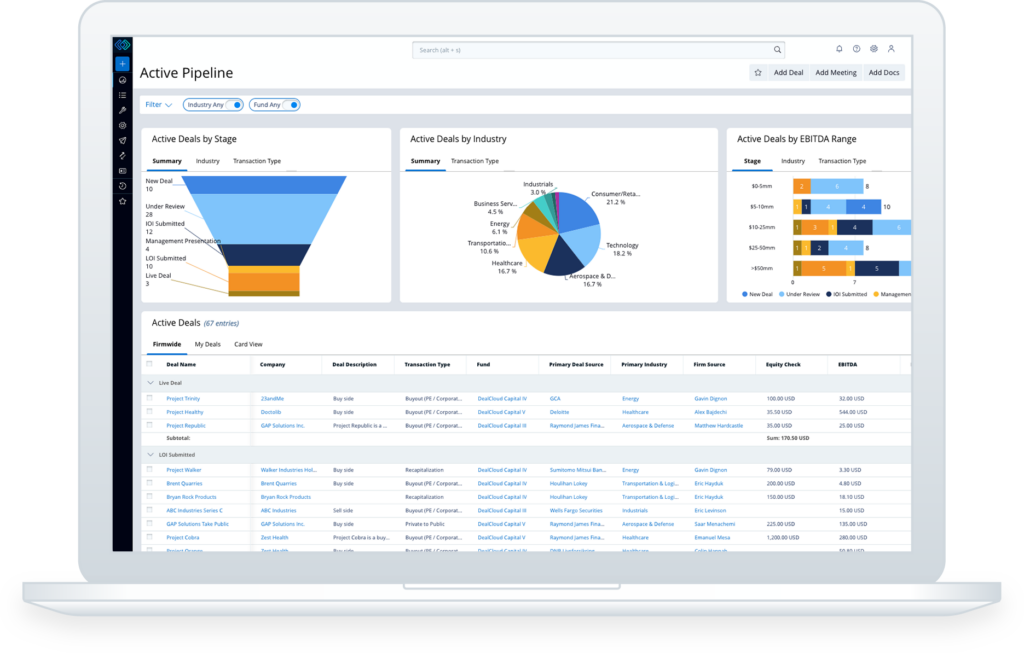

Manage your firm’s diverse investment strategies and expand your network so your team can close more deals. Discover and nurture meaningful relationships, fast-track strategy- or fund-specific pipelines, and streamline deal execution with Intapp DealCloud.