Intapp Conflicts

Identify and resolve conflicts of interest with speed and accuracy

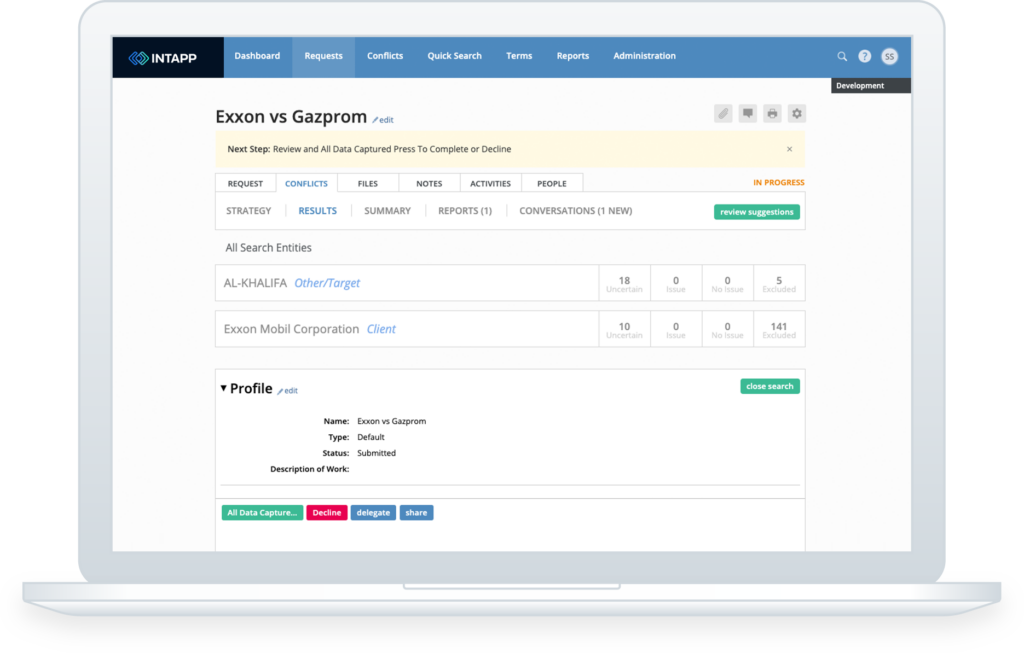

Quickly review, resolve, and report on conflicts of interest — all from a single destination. With Intapp Conflicts, your firm’s risk analysts can search and analyze potential conflicts using consolidated client information from both your firm’s systems and third-party data providers.

AI further speeds up your conflicts clearance process by flagging results containing potential or certain issues — focusing your analysts’ review efforts and saving them precious time.

Quickly surface and prevent potential issues with Intapp Conflicts

Protect your firm’s reputation and bottom line using the industry standard conflicts software for firms like yours.

Accelerate review

Reduce the time required to analyze and clear conflicts.

Improved decisions

Ensure decisions consistently align with the firm’s risk boundaries.

Clearer risk landscape

Centralize the information and processes that protect your firm.

Automating end-to-end conflicts management

When we went out … to explore what was available, there was no other product that could match the capabilities that Intapp Conflicts offered.

Intapp Conflicts

Move your firm’s business opportunities through the conflicts process quickly and accurately.

Mobile preliminary conflicts search

Run quick searches for potential conflicts while on the go.

AI-assisted review

Help analysts clear conflicts faster using AI to surface the potential issues.

Industry-specific risk factors

Track unique factors such as audit clients and applicable independence rules.

Configurable reporting

Streamline reporting with interactive conflicts reports.

Team conflicts review

Prevent conflicts by holistically reviewing other work of all team members.

Outside business interests

Surface outside business interests by integrating Intapp Employee Compliance.

Leading firms trust Intapp Conflicts

Frequently asked questions about Intapp Conflicts

-

Avoiding conflicts of interest is a critical part of maintaining and growing your business. Without purpose-built conflicts software for firms like yours, you increase your risk of reputational damage, legal or regulatory consequences, and costly fines.

-

Intapp Conflicts integrates with your firm’s existing systems that track client entities, corporate structures, and associated engagements. You can also enrich your firm’s data within Intapp Conflicts with corporate trees and industry codes from trusted third-party sources, as well as data about the disclosed financial interests of your employees by integrating with Intapp Employee Compliance.

Schedule a demo of Intapp Conflicts

Speak with an expert

Fill out the form and someone will be in touch to schedule a demo.

Intapp Intelligent Cloud

For more than a decade, Intapp has been bringing the power of automation and intelligence to professional and financial services firms — helping clients like you solve their specialized needs and challenges.

Intapp Cloud Infrastructure

Use AI confidently, knowing we keep your data secure through our partnership with Microsoft and our own commitment to security and compliance.

Learn more about our cloud infrastructureIntapp Data Architecture

Quality data is at the heart of good AI — and with Intapp, you benefit from our data architecture.

Learn more about our data architectureIntapp Applied AI

Our Applied AI strategy includes five essential AI capabilities that help you make smarter decisions, faster.

Learn more about our Applied AI strategy