The phrase “This could have been an email” perfectly sums up how most professionals feel about ineffective, time-insensitive meetings. Frustrated about wasting their time with in-person check-ins and stand-ups, today’s dealmakers want to digitize, streamline, and automate as many meetings as they can.

As many private equity firms and investment banks have moved to remote or hybrid work models — digitizing more of their processes along the way — private equity teams and bankers have an opportunity to streamline and even eliminate some routine appointments altogether.

1. Pipeline briefings

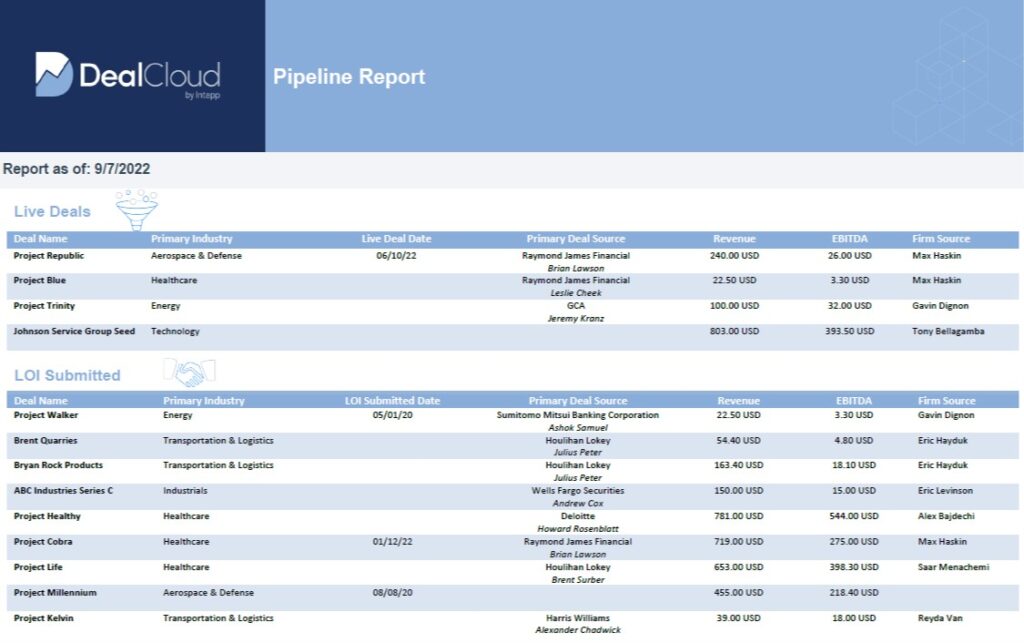

Intapp DealCloud’s deal and relationship management platform was purpose-built to help investment bankers and buy-side dealmakers stay better informed while also saving time. For example, using DealCloud, companies can email pipeline information to team members via templated reports — such as weekly deal tear sheets — at a scheduled time, rather than hold weekly pipeline meetings. The software automatically gathers, extracts, formats, and distributes the information to ensure that your team members have everything they need, when they need it. They can then review and discuss these reports asynchronously or offline.

You can create your own report template using DealCloud’s Microsoft Word add-in. Access your new template design under Tools > Template Reports, and schedule it for delivery whenever you choose.

2. Business development meetings for reliable deal flow

In a recent episode of the Capital Allocators Podcast, Jen Prosek, Founder and CEO of Prosek Partners, said that dealmakers should eliminate introductory business development meetings, as these preliminary exchanges are often unhelpful, inefficient, and time-intensive.

“I always say we don’t want to have the first meeting; we want to have the second meeting,” Prosek said. “Don’t…spend the entire time explaining who you are, what you stand for, what you do.”

Business development meetings are more productive if dealmakers share insights about themselves and their company to the contact in advance, then spend the meeting gathering key information about the contact, instead of simply introducing themselves.

“You want to have that second meeting in the first meeting, which [means] getting right to the point,” explained Prosek.

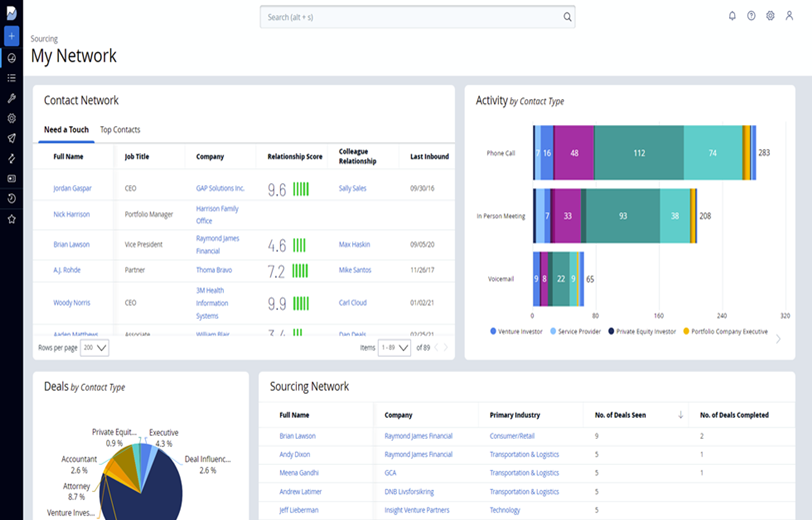

Technology can also help you identify new, high-potential contacts, and accelerate and streamline deal sourcing. DataCortex integrates with third-party data sources so you can get straight to business in your first meeting. Your company can leverage third-party tools like Equilar, which provides reliable corporate leadership data, and S&P Global Market Intelligence, a service that gives comparative information, industry metrics, and the names of leaders in your sector.

Just as business development teams are using technology to streamline their deal sourcing and introduction meetings, conference hosts and event coordinators are digitizing their business development conventions and expanding the traditional in-person experience. For example, SuperReturn, private equity’s most well-known North American business development event, lets attendees access event content online all year round.

3. Sponsor coverage meetings

Technology can also help with the intermediary side of a general partner’s deal flow. Even when deal volume is low, investment banks remain in constant communication with buyers so that when a good deal comes to market, they can approach the buyers who can partake in that deal. To determine which buyers are best suited for a deal, investment banks must maintain and update their buyers list — a task that takes a lot of time and effort.

To address this need, DealCloud lets investment banks automate the creation of their buyers lists. This automation process helps ensure that information is accurate and up to date, gives team members the information they need to pair opportunities with aligned buy-side teams, and eliminates the need for time-consuming meetings to discuss buyers lists.

Rather than spending their time researching buyers, your analysts can look at the company dashboard and access available information directly on the DealCloud platform. And by eliminating meetings and prioritizing their relationship management activities with sponsors, your teams can save time and energy, and work smarter, not harder.

4. Deal stage review meetings

With DealCloud’s automated reporting capabilities, your team members can send key deal updates via email instead of meeting for deal stage review. The reports provide insights into critical changes — such as talent allocation, next-step assignments, and at-risk measures — so they can take action right away. Your teams will also be able to access information such as deal stage, industry, firm source, deal status, and reasons for a deal’s failure.

DealCloud’s automated email alerts also update you in real time whenever a deal stage changes. If a team member takes action, the software will notify you and the rest of the team — so you don’t duplicate efforts or remain in the dark about the progress of that deal.

5. Investment committee meetings

To streamline investment committee meetings, you first need to make sure your firm’s busy partners and managing directors can quickly get the information they need. Ideally, that means implementing a robust information system with self-help portals and clickable dashboards.

Self-help portals for investor relations

A purpose-built investor relationship management system like DealCloud lets investment bankers and private equity groups configure portals for limited partners to share information and ask and answer questions. Executives representing the limited partners can use the portal to get up to speed before face-to-face meetings with your company, so they can focus on more pressing issues during the meeting.

Clickable dashboards for in-meeting data analysis

Traditionally, analysts prepared and distributed queried-and-printed database briefings for investment committee teams. Now, your analysts can save time by leveraging technology like DealCloud. DealCloud gives investment committee teams customizable, drill-down dashboards that display key data in real time. Meeting hosts can leverage the dashboard’s “drilling down” feature to share more details or answer any team questions that arise during the meeting.

6. Annual investor meetings

Many dealmakers have switched to hosting virtual or hybrid annual meetings by leveraging solutions that allow virtual hosting and attendance. Now, they need tools that can enhance their attendees’ experience.

Dispatch, our marketing solution, lets you batch-email attendees about important event updates like agendas, speaker lineups, preparation tips, and key topics. DealCloud also gives your team key engagement insights, so you can track who’s opening and sharing your email content (and who isn’t).

To make the most of your technology and deliver a strong experience, make sure your meeting chair completes virtual presentation training first, so your narrative and data visuals don’t get lost in the distractions of a difficult delivery. Take some time to learn what other fund managers and their bankers have learned from virtual annual investor meetings so you can avoid pitfalls.

7. Acquisition target business meetings

One of the most time-consuming aspects of acquiring assets in any financial services space is meeting and pursuing entrepreneurs, founders, owners, operators, and management teams among the businesses that private equity dealmakers buy. To cut your number of target meetings in half, invest in purpose-built solutions and follow these steps:

- Research your target’s position in their market. Qualify potential deals using third-party data providers like Equilar, which offers past and present corporate leadership information, and PrivCo, which shows what venture or general partnerships your targets have already been involved in.

- Identify a mutual contact. Avoid cold, lengthy introductions and instead use DealCloud’s relationship intelligence insights tool to learn more about your target. Having a mutual acquaintance gives you something in common to discuss.

- Email your targets forms instead of long information request lists. Instead of sending your target a lengthy preliminary information request list, you can create a simple form in DealCloud and email it to them. Your target can respond directly in the form, and their inputs will automatically populate into the system and appear on the target’s deal page.

- Track your targets’ responses and set alerts to follow up. With DealCloud, you can configure notifications to populate on a deal team member’s calendar, reminding them to follow up with a target based on the target’s reply status. DealCloud will automatically attach that event to the deal page so your representative has full context before reaching out — without having to manually search for the information.

Dealmakers no longer need to travel to meet and pursue targets and their leaders. During a conversation with fellow capital markets dealmakers at the Connect20 event, Paola Yawney, Head of Business Development at Balfour Pacific, explained how technology helps her and her team save time. Recently, her team began virtually touring real estate properties instead of traveling to those locations. By using technology to streamline and eliminate preliminary target meetings, Yawney has more time to focus on leadership-oriented work.

Explore how you can save time

Which of these seven meeting types can your group eliminate? Sign up for a guided tour of Intapp DealCloud today to learn how the platform can streamline and eliminate your time-consuming meetings.