Recently, Accounting Today hosted an in-depth panel discussion featuring Tom Koehler (Intapp) and Stuart Ferguson (Pointe Advisory), moderated by Michael Green (Accounting Today). The session explored findings from Accounting Today’s latest research survey and examined how private equity (PE), capital strategy, and AI adoption are transforming the accounting industry.

This recap summarizes the research objectives, survey insights, and expert commentary to help firms understand the link between private equity activity, AI investment, and long-term strategic planning.

Research objectives: Capital, growth, and AI readiness

Michael Green opened the discussion by outlining the primary goals of the research: to identify the capital needs of accounting firms and to assess how PE investment supports growth, technology modernization, and AI integration.

The study surveyed 304 professionals across firm sizes. Respondents highlighted that PE partnerships are increasingly viewed as a strategic path to fund technology transformation, strengthen governance, and competitively scale operations.

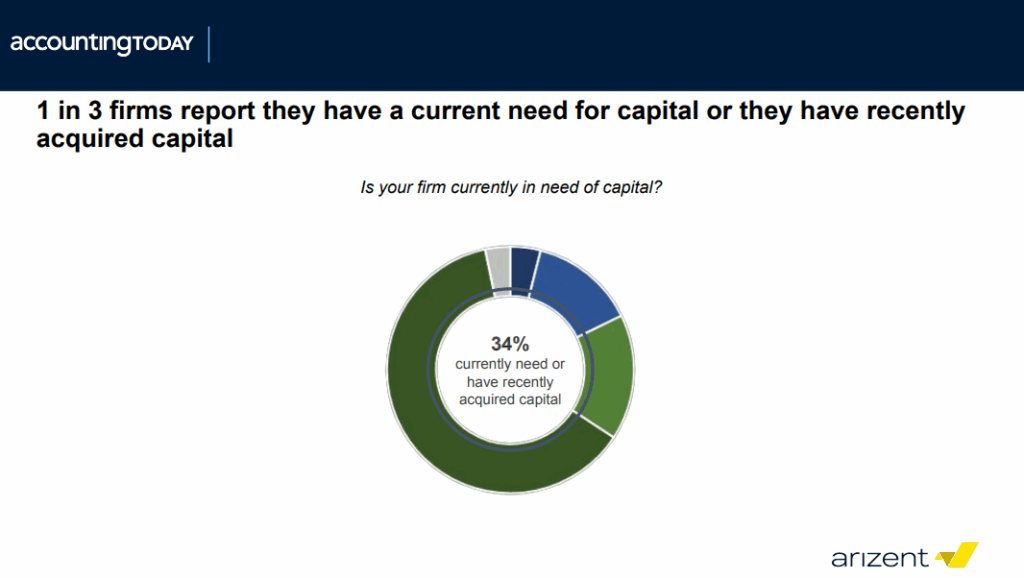

Capital needs: Strategic demand is rising

Although two-thirds of surveyed firms indicated no immediate capital needs, panelists agreed that this will shift quickly within the next 12 to 24 months.

Tom Koehler noted that rising demand will be driven by strategic opportunities, technology investment requirements, and demographic pressures rather than financial distress.

Stuart Ferguson emphasized recapitalization for succession planning as a key challenge. Many firms cannot manage retirements or generational transitions without external funding. On this point, Stuart said:

“It is really hard to do deals at current valuations if you do not have an outside pool of capital.”

Both speakers observed that the market is dividing between firms that can invest proactively in technology, including AI, and firms that are forced to respond reactively to competitive pressures.

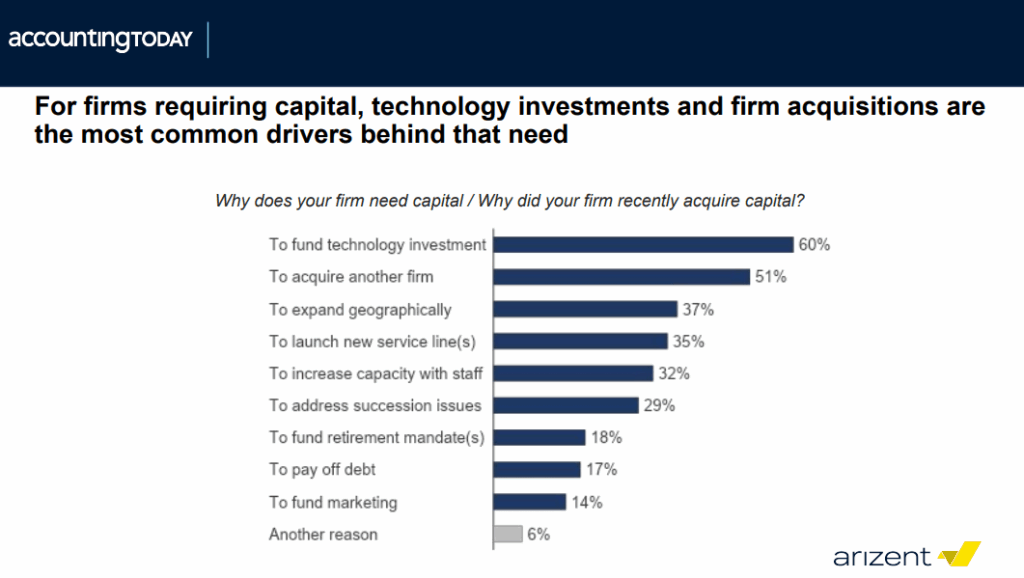

Survey Insights: Where Firms Are Deploying Capital

The survey identified specific reasons firms seek external capital:

- Funding technology modernization and AI-enabled platforms

- Supporting M&A activity

- Expanding into new geographies or service lines

Stuart emphasized that technology investment, especially in AI, is increasingly a necessity for firms seeking to maintain competitiveness.

Tom noted key differences across market segments:

- Large firms deploy capital for acquisitions, platform builds, and AI-driven transformation.

- Mid-sized firms use capital to fill staffing gaps or address succession pressures.

Economic drivers and strategic effects

Panelists identified three forces driving increased capital needs:

- Recapitalization linked to succession transitions

- Talent acquisition, especially lateral hires with specialized expertise

- Technology adoption, including AI and workflow automation tools

Tom emphasized that governance alignment is critical.

“Your capital strategy should serve and amplify your commercial strategy,” Tom clarified.

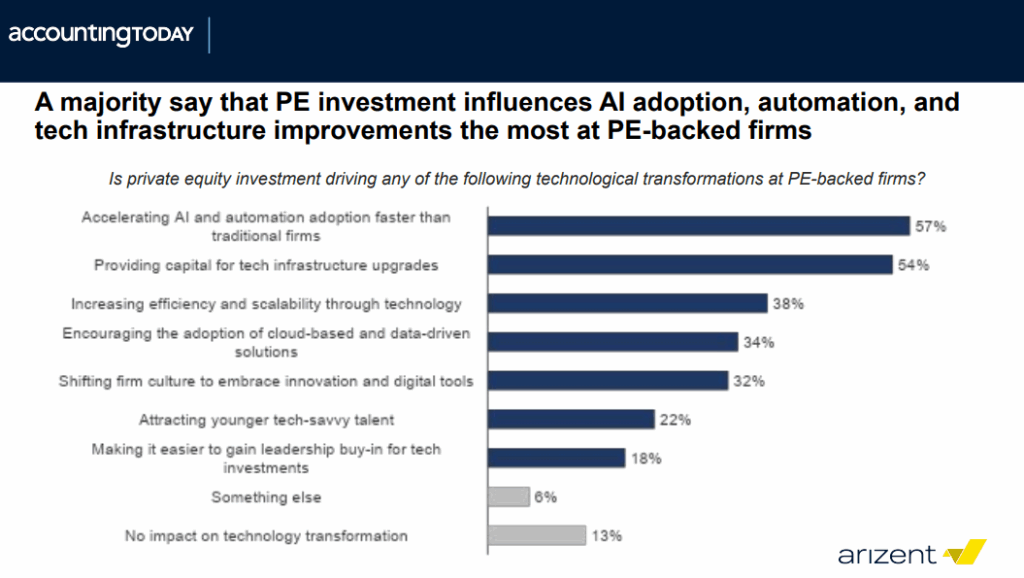

Private equity’s expanding role in accounting

The panelists highlighted that private equity now provides more than capital. PE partners deliver operational expertise, modernization frameworks, and technology resources that help firms scale intelligently.

Tom described PE as a source of patient capital that enables innovation beyond the limitations of traditional partnership structures.

Stuart noted that PE-backed firms are better prepared to invest in AI platforms, data infrastructure, and M&A integration to meet competitive challenges.

Looking ahead: Shifts in strategy and execution

As PE investment accelerates, firms can expect to see:

- Increased focus on specialized, high-margin advisory services

- Greater adoption of AI-driven tools across audit, tax, and advisory workflows

- A shift from reactive cost containment to proactive investment in revenue generating technology

- More structured operating models designed for scalability

Tom predicted that capital deployment will shift toward technologies that enable revenue growth, with AI playing a central role in that shift.

Taking action: Strategic priorities for firms

Firms evaluating PE partnerships or planning for technology transformation should prioritize:

1. Technology investments

- Implement AI enabled platforms for workflow automation

- Strengthen data infrastructure to support analytics and client reporting

- Deploy intelligent document processing and generative AI capabilities

2. Talent strategies

- Recruit professionals with AI literacy and digital competence

- Build hybrid teams combining accounting, analytics, and operations skill sets.

3. Governance and capital alignment

- Create governance frameworks that clearly link capital deployment to strategic outcomes

- Strengthen decision making structures to avoid misalignment between investors and firm leadership

4. Market positioning

- Use capital to expand geographic footprint or launch differentiated services

- Leverage technology to enhance client experience and advisory value

Conclusion

The growing influence of private equity and AI adoption across accounting firms was reinforced throughout the webinar. Capital is becoming a strategic enabler that supports modernization, talent strategy, and competitive differentiation.

As demographic shifts, technology pressures, and client expectations accelerate, proactive investment will be essential. The insights shared by Tom, Stuart, and Michael offer a clear roadmap for firms preparing to navigate this period of industry transformation.