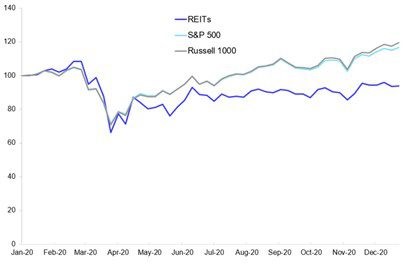

Real Estate Investment Trusts (REITs) reached a low point in mid-to-late March 2020, dropping approximately 42% from their February 2020 peak, while major market indexes also declined to a similar extent. This was, perhaps, to be expected as the pandemic took hold and fears of a real estate collapse grew.

However, as the S&P 500 and Russell 1000 recovered and returned to pre-COVID marks by year-end, REITs were still lagging significantly, ending 2020 down about 15%.

2020 REIT Performance Compared to Major Market Indexes

As investors become increasingly antsy for improved returns, it’s important that REIT managers focus their energy on what moves the needle — generating income and identifying new opportunities — and spend less time on tedious administrative tasks.

Keeping up with market demands while meeting regulatory demands is no easy task. REITs must find a way to keep a finger on the pulse of the market while also ensuring data remains secure, clean, and compliant at all times. This can be difficult if REITs don’t have clear processes and the right tools in place for daily operations, deal management, and reporting.

Despite this concern, REIT deal management — along with the wider real estate ecosystem — is still notoriously antiquated in its approach to everyday processes, according to a 2020 report from the Pi Labs X Oxford Future of Real Estate Initiative. This organization found that deals are still often sourced face-to-face through personal networking; deals are still often based on market rumors, and parties still expect hand-signed documents sent by mail — then scanned and saved, or stored in filing cabinets. Furthermore, a whopping 60% of firms still use spreadsheets as their primary reporting tools; 51% use them for valuation and cash flow analysis; and 45% use them for budgeting and forecasting, creating many opportunities for error and an overall lack of transparency.

Bob O’Brien, Vice Chairman and Real Estate Sector Leader for Deloitte recently highlighted the importance of moving the industry into the 21st century. “Given some of the challenging conditions out there impacting REITs’ ability to grow their top lines, we think technology today provides an opportunity to grow their bottom lines, to drive cost out of the business, and to optimize the revenue they are earning,” said O’Brien in an interview with REIT.com.

REITs are competing for capital among an ever-widening investor base — one that now has a close eye on non-financial and non-administrative work as well as financial performance. As a result, REITs must deploy deal management technology to alleviate cumbersome reporting processes and analyze data to compete in key markets.

As the COVID-19 pandemic and work-from-home mandates pressured professionals, many REIT management teams started to increase their use of cloud-based collaboration and productivity tools to closely monitor and generate opportunities, reduce technology costs, and increase flexibility. They recognized that the right technology stack was vital to bring together all their policies, procedures, and data in one centralized location.

REIT Deal Management Technology Improves Operations

Intapp DealCloud’s REIT deal management solution centralizes key information, market data, and financial models to help managers develop successful deal strategies and meet investment targets.

With data-based insights from DealCloud, REITs gain a more thorough understanding of relationships —simple conversations as well as current and past deal flows. The platform is designed specifically for the commercial real estate industry and customized for each REIT’s goals and specialty industries.

Understand Their Deal Flow and How Trends Change Over Time

If investors are unfamiliar with a geographic market, they’ll need to get educated on the area’s makeup and history before key meetings. To help with this need, DealCloud includes occupancy and demographic data from top data sources like Preqin, FactSet, PitchBook, and S&P Global Market Intelligence. Key data appears right alongside dashboards outlining the deal pipeline and portfolio, allowing real estate investors to inform investment theses, originate and close deals, and monitor portfolios.

Additionally, as relationship-building with stakeholders has become more difficult during the pandemic, many REIT users deployed DealCloud Dispatch, a fully integrated marketing solution, to reach investors with pre-scheduled and templated deal announcements, press releases, industry coverage and analysis, newsletters, holiday cards, and many other communications.

To learn more about how Intapp DealCloud can help your REIT deploy deal management technology internally get back on the right track and alleviate your administrative workload, schedule a demo.