Many corporate acquirers are on the hunt for their next big transaction. But they aren’t alone: Competition for high-quality assets is high, and supply is limited.

Today’s corporate development professionals need to act quickly to successfully bid on and negotiate deals. They also need accurate, up-to-date data to build and maintain relationships with private company owners and executives.

With the right deal management software, your corporate development teams can better showcase your firm’s value. Learn which key features and functions your transaction and business development professionals need to thrive in today’s competitive environment.

Improve deal management with custom workflows

Many firms have small corporate development teams — or even just one person — to manage the M&A process. These people often keep all the process information in their heads or on their desktops. But what happens when that information needs to be shared with corporate leadership or with new members of the corporate development team?

When information is inaccessible or disjointed, simple tasks like seeing which deals are at which stage can be arduous. And revisiting deals can prove to be impossible if there’s been turnover at the company or the deals have become stale or lost. Corporate development teams need a centralized system where they can easily track and manage this vital information, so they can quickly determine how best to move forward with a current or potential deal.

Corporate development deal management software can provide transaction professionals and their colleagues with key insights about their deal flow and relationships. Users can configure notifications and tasks to encourage ownership and accountability. And leading corporate acquirers can even visualize key deadlines and meetings in a calendar view for the deal team and C-suite to see.

With all this information readily available in one place, your corporate development team can confidently accelerate workflows and improve the M&A process.

Track and document complex business relationships

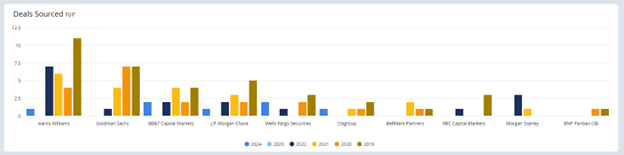

In addition to directly managing their relationships with CEOs and other executives, it’s important for your corporate development professionals to stay up to date with other deal sources. With deal management software, transaction professionals can easily view which bankers, brokers, advisors, and other intermediaries the corporation has sourced deals from over time. They can also view how many deals were sourced and which strategy those deals align with.

Corporate development teams can also use deal management software to alert team members about how long it’s been since they’ve talked to or had a meeting with a key relationship. They can also can leverage the software’s relationship intelligence to calculate the strength of the connections between both individuals and firms — without conducting time-consuming research. This lets professionals quickly determine the best next steps to strengthen or maintain key relationships.

Put data into action

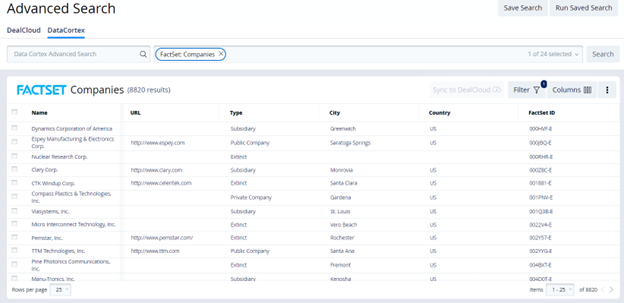

Information is only valuable if it can be applied — which is why corporate acquirers must leverage private company and transaction data to inform their decision-making. This data allows even the most niche firms to search for potential acquisition targets by sector, subsector, complex industry services, solutions, and other parameters.

Corporate development teams often don’t have robust databases of their own, and must rely on third parties to provide them with data. Your firm should seek out a partner that offers integrations with PrivCo, FactSet, Preqin, PitchBook, and other industry-specific data providers.

Upgrade the deal-making process

Although competition for high-quality assets is intense, the right deal management solution will help your corporate development team achieve better outcomes. These systems, combined with the power of proprietary and third-party data, make it possible for your corporate acquirers to better compete against similar companies, private equity buyers, and other entities.

Schedule a demo to learn more about Intapp DealCloud and our deal management software for corporate development teams.