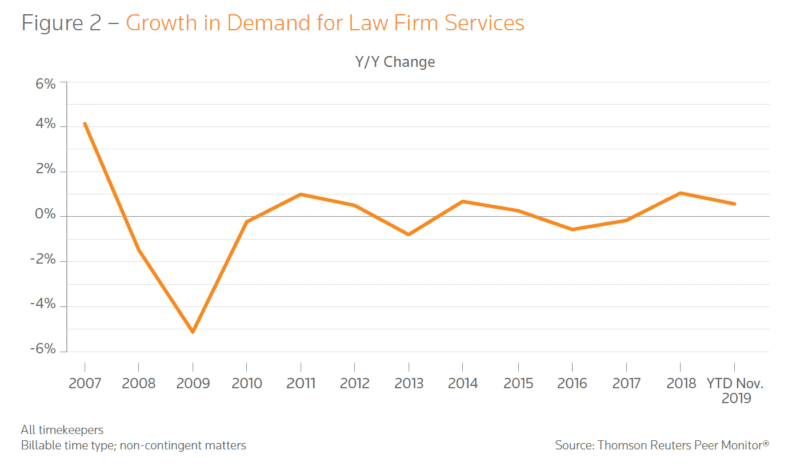

The usual industry reports, 2020 Georgetown and Peer Monitor State of the Industry as well as the Citi Hildebrandt Client Advisory Survey released earlier this year echo the sentiment heard across law firms – the business model is changing. Amidst modest overall demand for law firm legal services (Georgetown reporting < 1% increase year-over-year) many firms saw strong growth in 2019. Breaking it down, Am Law firms outperformed the average growth rate while mid-size firms struggled with flat growth. This modest demand has been the reality for the broader market for nearly 10 years now. It speaks to the share of wallet for law firm legal services shrinking in favor of in-house and the growing number of alternative service providers including The Big Four.

Impact of COVID-19 on law firm trends

The shared demand for legal services came as one of the by-products from the last economic downturn in 2008 (market factors that were brewing to only be exacerbated by this exogenous “shock” to the economy, as law firm clients were asked to reign in expenses and operationalize their work presenting a ripe opportunity for disruption from alternative providers). Firms have pivoted, albeit slowly, over the next nearly 10 years leading up until now. During that time, the market has seen departures (large firms like Bingham McCutchen) and disruptions that have forced firms to find new ways to compete but none like the unique scenario that the COVID-19 pandemic presents.

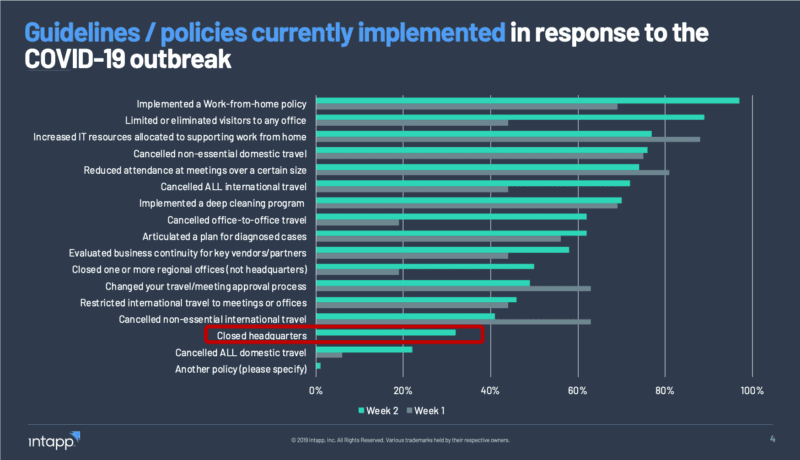

The COVID-19 pandemic has forced (rather quickly) a traditionally in-office culture to a virtual work environment. With the general safety of the public a top concern alongside state-wide quarantines and “shelter in place,” firms just like everyone else have had to accommodate. According to Intapp’s COVID-19 pulse survey taken on March 18 – March 20th by firm leadership, 97% of firms have implemented a work from home policy, that has meant increased IT resources to support the new virtual workforce for 77% of firms. From purchasing hardware and deploying collaboration software to stress testing, the business model had to flex quickly.

Technology helps bridge the gap in new COVID-19 reality

The increase in IT to support work from home is an early innings pivot for firms with respect to this outbreak. Many firms had already started to innovate through investing in technology with growth to this expense in 2019 of 4.5%, according to Citi. A number that is anticipated to grow in 2020 as firms are now forced to rethink the way they work when they can no longer knock on a colleague’s door to cross-sell or shout down the hall to get help with insight into the firm’s experience. Internal issues aside, other questions arise about how to nurture client relationships without in-person meetings or events. With 89% of firms limiting or eliminating visitors from the office and 85% of firms cancelling in-person meetings as well as non-essential travel cancelled internationally (72%) and domestically (76%), it is technology that firms will have to rely on more than ever to help ensure a seamless firm experience, provide insight, and add value.

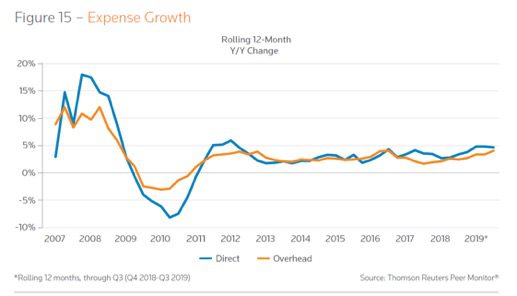

The speed of change to the business model will perhaps distinguish the winners and losers coming out of this economic downturn. In the past, we’ve seen spend decrease as the economy resets (see chart below). During 2009-2011, firms cut expenses dramatically. This came in the form of smaller summer associate classes, layoffs, de-equitization and decreases to spend in areas like technology. While we are already starting to see some of this (firms are reporting layoffs and salary cuts for mid-size and large firms (NY firms, Womble), recruitment is slowing if not stopped and potential changes to summer associates), the unique value proposition brewing will require firms to accelerate technology investment rather than pullback.

Firms increase IT spend to support work from home culture

The increased spend in technology needed to support a decentralized digital workforce is already underway with over a quarter of firms increasing IT resources to support work from home. The next rounds will come by way of technology that will support firms revenue goals (read; information sharing from clients and process at the firm) and may offer some discomfort, as the general sentiment at firms is that “the firm culture clashes with what we need to do now to work from home and operate in new ways”.

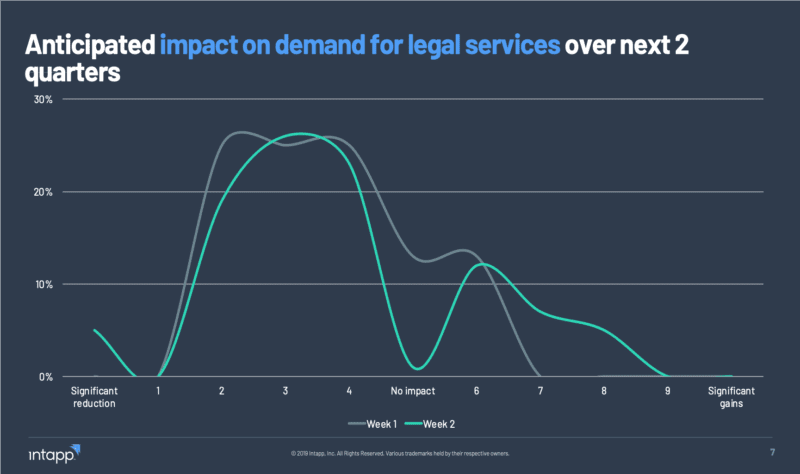

However, with the decrease in the demand for law firm legal services over the next two quarters anticipated by 73% of firms (graph below) and some firms already seeing this manifest with 51% experiencing a reduction to billed hours, it is clear firms need to respond to clients quickly to nurture relationships virtually. In the recent ALM COVID-19 webinar on “Navigating the Coronavirus Pandemic: How Firms Are Aiding Clients and Running Their Own Operations,” an in-house panelist reminisced about 10 years ago when specific firms reached out as a trusted advisor during a time when advice was needed, offering support by way of reduced rates and “free” advice. The relationships nurtured during this time have proven to hold the strongest over the next decade.

New (virtual) business models emerge for law firms

What will firms do to replicate this scenario virtually? Without in-person meetings and events, the inability to connect among other lawyers within the firm coupled with slipping demand, the business model moving forward will have to include a way for lawyers and clients to connect virtually, sharing information with value adds (in hopes to relieve some pressure on rates which climbed 4.5% in 2019, reflecting the strongest growth since 2008 according to Citi) to differentiate themselves. Ron Friedmann is keeping track of some of the resources firms are providing at this time (Law firm COVID-19 resources) from data resources to toolkits, advisory groups, and task forces. But it is only the beginning, as firms develop strategy around the investment in technology that will foster new processes that come out of working remotely to help nurture the client relationship (and drive efficiency at the firm) beyond industry thought leadership.

Even the 24% of firms that are anticipating growth in the near term will need to find ways to support these efforts from afar. Perhaps the optimism is from firms with strong labor and employment, real estate, M&A and bankruptcy practices (since 27% of firms are already seeing growth to these practices). Not far off from a trend we saw during the last economic downturn when growth in demand for certain practices in the ALM101-200 and mid-size firms grew while other larger firms saw reductions. The question comes down to: how does the virtual dimension of COVID-19 change the way firms will deliver these services with demand up or down? From the actual legal work to anticipating client needs across lawyers, to practicing law in virtual court, the next chapter will lay the inroads that force firms to transform the virtual legal business model.

For more insight into what is top of mind for law firms leaders week-to-week in response to COVID-19, check out our on-going survey.