The COVID-19 pandemic led many firms to abandon the idea of returning to business as usual and reassess many traditional risk management practices. As revealed in the 2021 Intapp Risk Staffing Survey Report, firms enacted new risk policies and invested in technology for risk management teams to preserve the overall risk-mitigation function while addressing new client and industry expectations brought on by the pandemic.

Intapp Terms, part of the Intapp Risk & Compliance suite, helps firms track client obligations and comply proactively with their specific requirements around data privacy and security, invoicing, commercial conflicts, and information governance. With Intapp Terms, firms can:

- Automate review and workflow approvals

- Search across all clients and identify specific clients when incidents occur

- Identify what terms are in effect across time and documents

- Leverage full-text capabilities to search across all terms documents for potential new issues

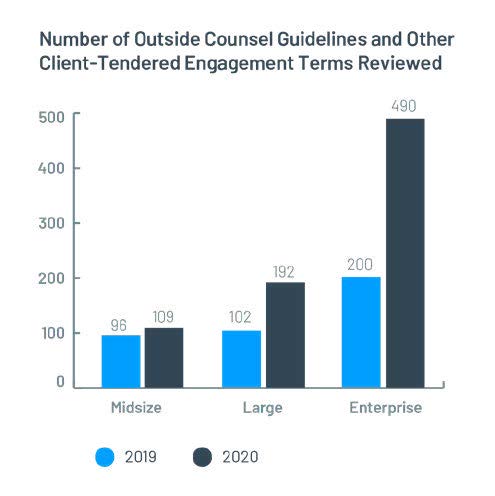

Intapp Terms can also help firms address the ongoing increase in outside counsel guidelines (OCGs) and other client-tendered engagement terms. This growing volume of OCGs and terms has proved particularly difficult for firms within the past 2 years, with some reviewing almost double the quantity as compared to prepandemic years. By leveraging Intapp Terms, risk management teams can maintain centralized control over the distributed review of OCGs and other client-tendered engagement terms by subject matter experts.

The pandemic has also driven firms to pivot to a remote business model and invest more heavily in technology to support home offices and disperse teams. Traditionally, firms have invested in individual departmental technologies that support the following functions:

- Risk and compliance

- Knowledge management

- Information technology

- Marketing and business development

- Operations and finance

Alternatively, firms can invest in cloud-based connected firm technology such as Intapp Risk & Compliance to connect their people, processes, and data — all via a single platform. Firms can focus on the client engagement lifecycle and easily coordinate end-to-end operations across departmental silos and business lines.

Intapp Risk & Compliance — which consists of Intapp Terms, Intapp Intake, Intapp Conflicts, and Intapp Walls — offers risk professionals critical capabilities to thoroughly evaluate new business, quickly onboard clients, and easily monitor relationships. Firms can purchase the entire cloud-based suite or any of its individual products, all of which integrate with one another.

Download the full Intapp 2021 Risk Staffing Survey to learn more about improving your firm’s risk management strategies in a post-pandemic market.

Schedule a demo to learn how Intapp Terms and Intapp Risk & Compliance can help your risk management team maintain the best possible operational and performance proficiency.