Intapp DealCloud

Deal and relationship management for private capital advisory and fundraising

The Intapp DealCloud blueprint for private capital advisory and fundraising lets your firm harness the cumulative intellectual capital of your people and processes — helping you manage relationships, originate deals, and grow your business across sponsors and LPs.

Develop deeper relationships with GPs

Approach GPs with greater insight into their business and a

complete 360-degree view of your relationship.

- Fund insight: Easily view a GP’s funds and underlying fund information including fund commitments, portfolio companies, and secondary sales.

- Relationship view: See a complete history of engagements, fees generated, key discussions, and other key information.

- Third-party data integrations: Integrate key data from popular third-party data providers including Preqin and PitchBook.

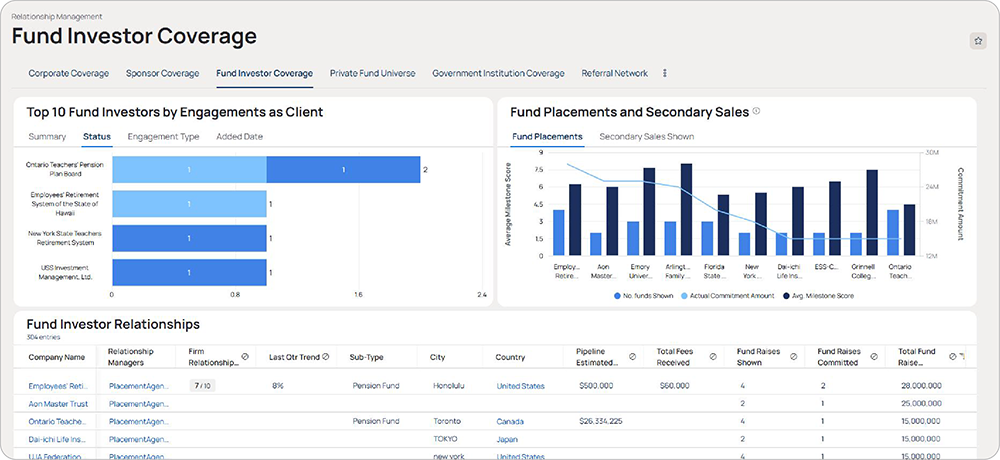

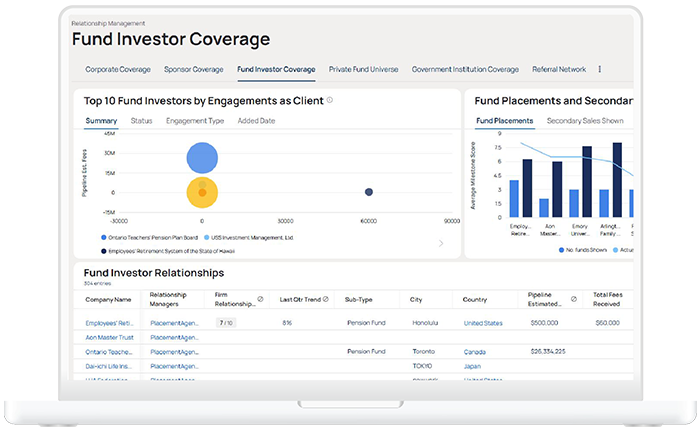

Gain greater insight into LPs

Centralize LP information so you can grow your relationships

and identify opportunities more easily.

- Fund commitments: Quickly view all of an LP’s commitments and associated information.

- Investment preferences: Easily track an LP’s investment preferences so you can match them with future opportunities.

- Engagement history: Get a complete view of your LP engagement history that includes fund placements, secondary sales, and other data.

intapp.com

1

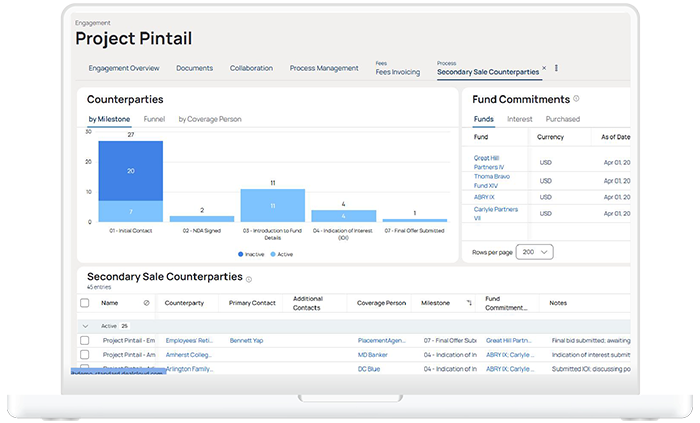

Close transactions faster

DealCloud helps you execute deals more efficiently for GP led secondaries,

LP led secondaries, GP capital advisory, and primary fundraising.

Marry GPs and LPs using market intelligence

Centralize insights and intelligence about pricing history, investment preferences, and other data to connect the right GPs and LPs and close transactions more quickly

- Build investor lists: Curate investor lists from past processes, and surface “suggested buyers” based on investment preferences.

- Track investors: Efficiently move potential investors through the funnel and track deal notes.

- Custom reporting: Get daily reports to keep you and your client up to speed on the deal process and where potential investors stand.

Execute deals more efficiently

Seamlessly execute private capital advisory and fundraising deals by moving investors through the process efficiently and leveraging robust reporting.

- Market intel: Quickly view what was sold in the market, at what price, and to whom.

- Investment preferences: Easily track and filter investment preferences to identify the best potential investors.

- Fund insight: Rapidly access notes on funds, pricing history, and who viewed funds previously.

Contact your Intapp representative to learn more.

intapp.com

© 2025 Intapp. All rights reserved. Intapp is a registered trademark of Intapp or its affiliates.

Other trademarks held by their respective owners.