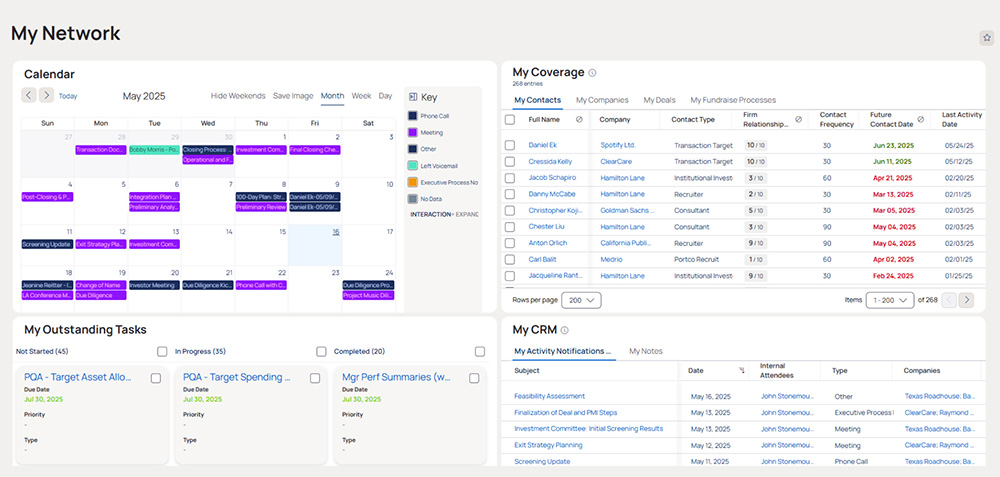

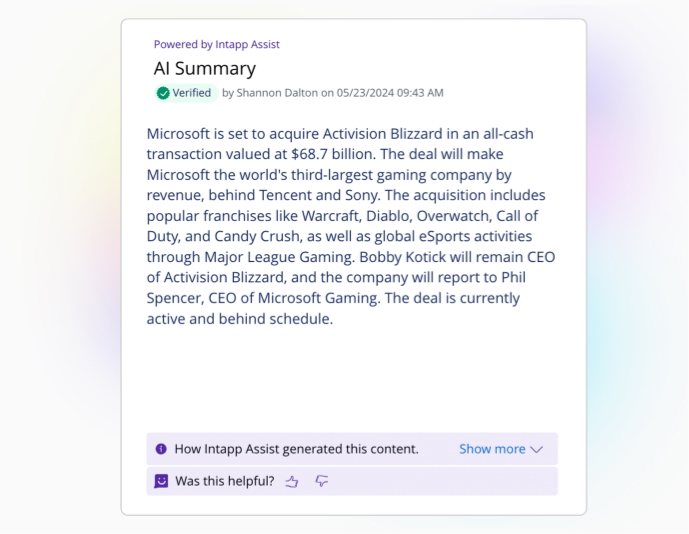

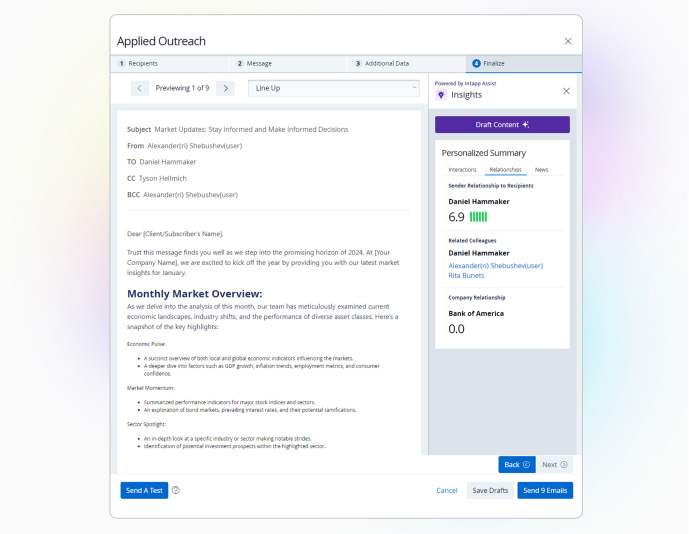

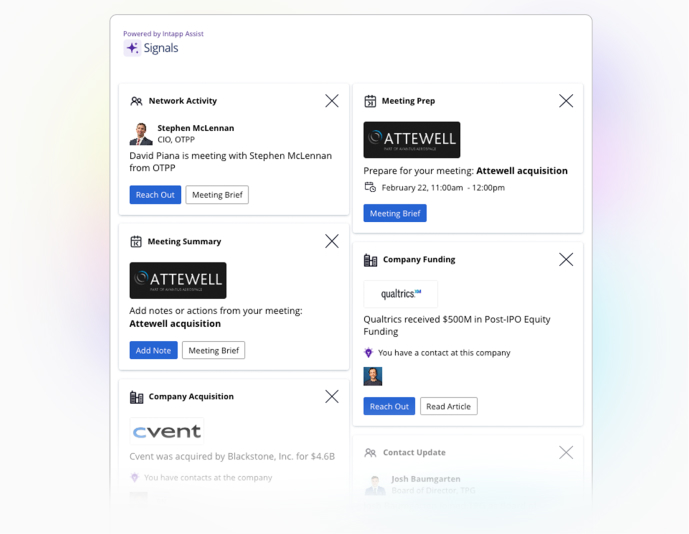

Find and close the most profitable deals — before your competitors do — with an AI-powered platform built just for private capital professionals. Intapp DealCloud connects your firm and market intelligence so your dealmakers and other team members can accelerate execution, build stronger relationships, analyze industry trends, and evaluate active targets — all from one centralized location.