A few years ago, Intapp Risk Consulting was assessing an international law firm’s new-business inception program. When consultants asked a billing partner representing a U.S. bank how he handled his client’s outside counsel guidelines (OCGs), he said, “I sign them and throw them into my bottom desk drawer.”

Seeing the consulting team’s incredulous looks, he continued, “I guess that’s not the right answer.”

The need to manage a growing quantity of client commitments — including those presented in requests for proposals, OCGs, engagement letters, and waivers — has created an administrative tsunami. Nevertheless, recent research shows that a growing number of firms are recognizing the importance of matter management. Altman Weil’s 2019 Chief Legal Officer Survey, for example, reported that 81% of surveyed corporate legal departments “provide guidelines for billing, expenses, matter staffing, and matter management.”

Managing a law firm’s formal client commitments has become a permanent administrative function, and it’s essential that firms put processes in place to fully comply with these obligations.

Creating a Collaboration of Matter Experts

Law firms have discovered it takes a collaborative team of administrators to review potential client commitments substantively and negotiate final terms. The evolving leading practice involves subject matter experts from various disciplines, including:

- Office of the General Counsel and the risk organization

- Accounting and Finance

- Marketing and Business Development

- Records and Information Governance Management

- IT Services

- Human Resources

- Practice Management

Establishing a Model Process

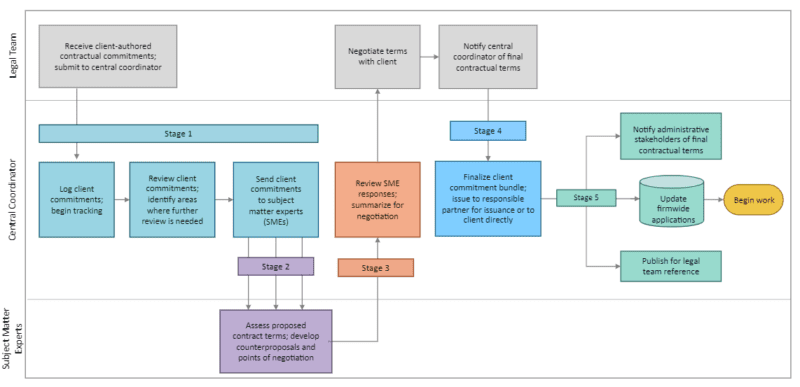

Given the quantity and diversity of subject matter experts involved in the assessment of client commitments, it’s important to formally map out a process so that all parties clearly understand the responsibilities.

Stage 1: Lawyers and staff should forward RFPs, OGCs, client-authored engagement letters, and other client commitments to a centralized coordinating team to track and distribute; this gatekeeping role is usually the responsibility of an office of general counsel or accounting department.

Stage 2: For expediency, the review team should establish an editing protocol to document the final terms and conditions. Edits should be controlled via modifying addenda rather than redlining.

Stage 3: SMEs return their reviews to the coordinator who summarizes points of negotiation that need to be addressed with the client.

Stage 4: At the conclusion of negotiations, the firm finalizes the engagement terms and issues them to the client. Today, this responsibility is usually handled by the responsible partner, but — given the number of administrative tasks dependent on the execution of the agreement — Intapp predicts this will become a responsibility of a central coordinator team.

Stage 5: Once client commitments are executed, several steps must happen quickly and simultaneously so client work can begin:

- The administrative teams responsible for executing against the agreed commitments must be notified of the negotiated terms so they can comply.

- The firm must update its client-matter management systems to ensure the proper, synchronized management of engagement data.

- The firm must make the terms of the engagement available to the legal team for reference.

Administrative tasks typically take two days per stage, for a total elapsed time of two business weeks — a week for reviewing the proposed commitments and preparing negotiation points, and a second week dedicated to putting approved client commitments into effect.

In Part Two of this series, we will explore how firms can best tackle a repository of executed commitments and address new client commitments.

Download the full white paper to learn more about roles and model processes for client matter management.