Grow your network, identify quality targets, and close more deals with Intapp DealCloud.

By creating a central hub for all information regarding targets, relationships, and deals, DealCloud helps your firm operate more efficiently and strategically.

Growth equity software and solutions

Coming from a traditional CRM, it is refreshing to use technology designed specifically for private equity professionals … tailored by a knowledgeable team that understands our sector and investment processes.

DealCloud enables us to further leverage our deep network and enhances our ability to source and execute proprietary transactions.

Growth equity firms need strong relationship management practices, efficient capital deployments, and finely tuned investment themes to compete in today’s competitive deal landscape. Microsoft Excel spreadsheets and generic CRM platforms can’t effectively support growth equity firms because they were built to support a different business model — a model that doesn’t take nuanced strategy into account.

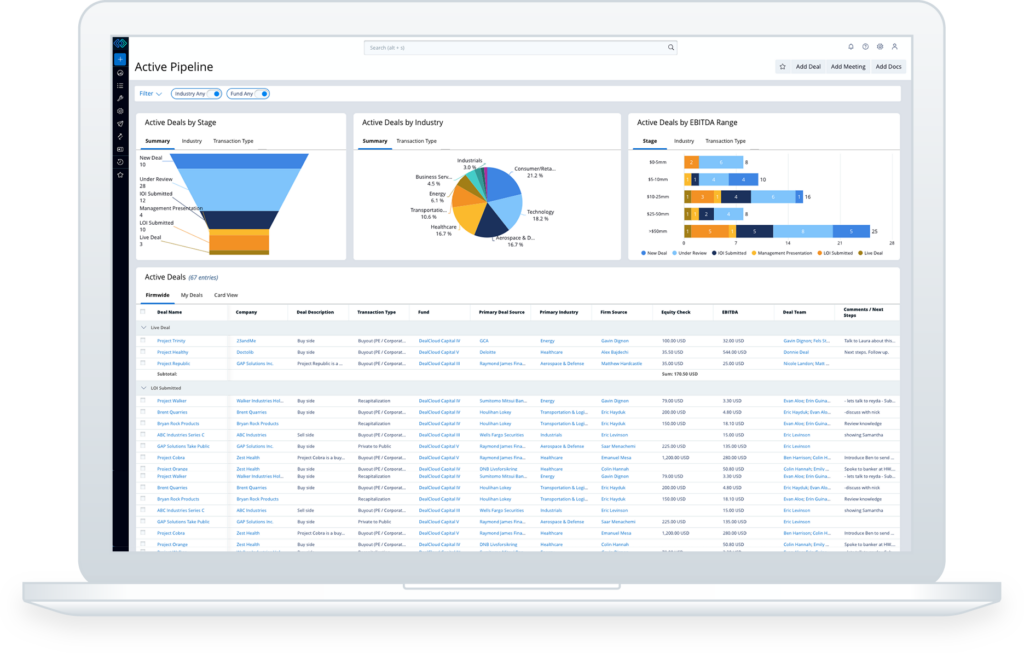

The rise of vertical-specific CRMs, like Intapp DealCloud, has made it easier for growth equity firms to keep all their contacts, activities, and other critical information in one place. But Intapp DealCloud is more than just a CRM. Equipped with transaction workflow capabilities and team collaboration functionalities, Intapp DealCloud offers a state-of-the-art deal and relationship management system for growth equity investors.

Growth equity firms need to monitor developments in their target industries and regions as well as track emerging trends. That’s why they leverage Intapp DealCloud to deploy capital and execute on their strategies and initiatives, including private company monitoring, business development, relationship management, intermediary coverage, deal and pipeline tracking, and fundraising and investor relations.

Our platform was built by industry experts who know that not all growth equity firms operate in the same way. The pipeline, relationship management, and reporting needs of one user, team, division, or company may differ greatly from the next. That’s why our users have the granular control to tailor Intapp DealCloud on a user–by–user basis — so that every individual has the tools and views they need. When it comes to reporting and analytics, your team members can customize every dashboard, chart, graph, tearsheet, data sheet, and profile to meet their preferences and interests.

Fill out the form and someone will be in touch to provide a demo.