Building connections with top-level professionals is vital in any business deal, and keeping those connections is even more important. Private equity professionals benefit from building and overseeing these relationships to find leaders for their portfolio companies.

Harvard Business Review‘s research reveals that private equity firms usually change CEOs when they invest in a company. Private equity firms need efficient talent tracking software to simplify hiring and find the right candidates for their portfolio companies.

Intapp DealCloud helps private equity professionals track executive talent easily. They can use custom dashboards and reports on the same platform where they manage deals and relationships. Private equity leaders can use the Executive Network dashboard in DealCloud. This allows them to find top candidates and achieve the best results for their investment firms.

Find the best candidates for executive roles at portfolio companies

When private equity dealmakers make an investment, they evaluate how to achieve the greatest outcome in that investment. Many times, this means finding new executive talent to lead the portfolio company and help the organization grow.

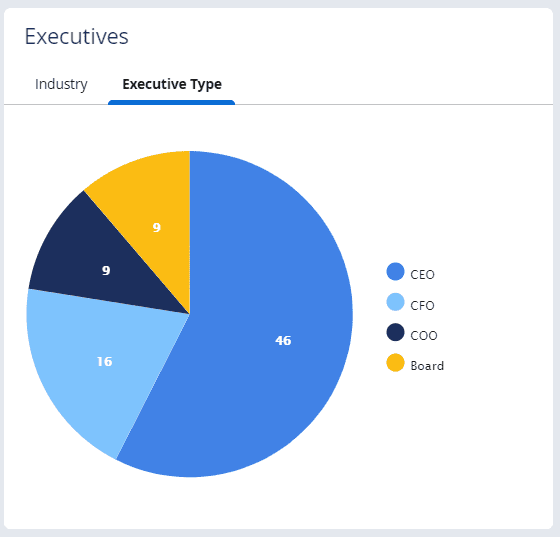

Private equity firms can use DealCloud to assess their business requirements. They can also use it to identify suitable executives from their network for portfolio companies.

Factors that they consider include the executive’s past industry experience. They also consider the specific executive profile required for the position. They consider factors such as the executive’s past industry experience and the specific executive profile required for the position.

Private equity firms have an advantage over competitors when making investments by using executive talent tracking software. This software helps them determine the type of executive they need for a new role.

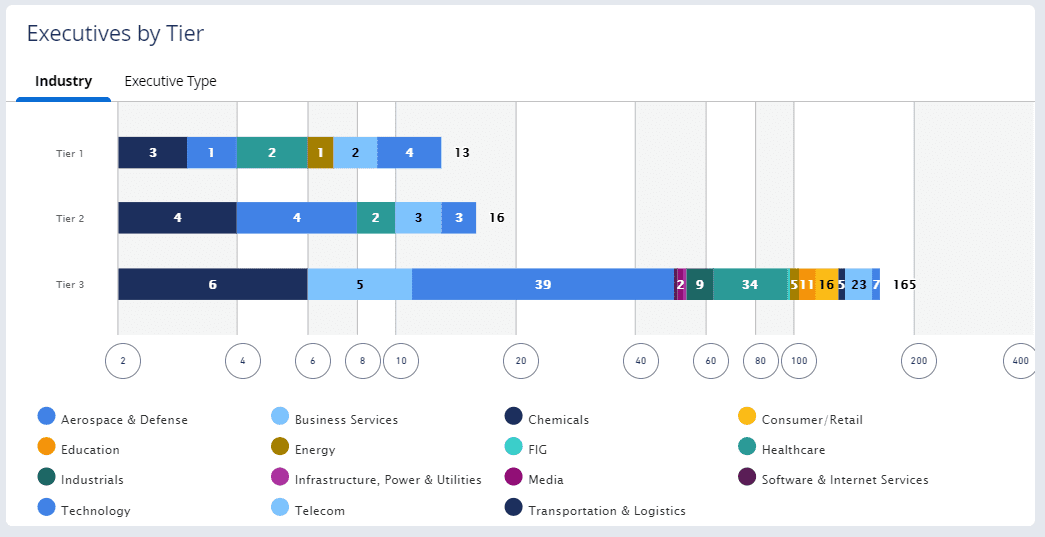

Categorize and tier executives for optimal placement

Private equity professionals have many executives in their network, so it’s hard to find the right contact for an executive role. DealCloud lets users tier executives by industry and type to gain a clearer view of the strongest candidates.

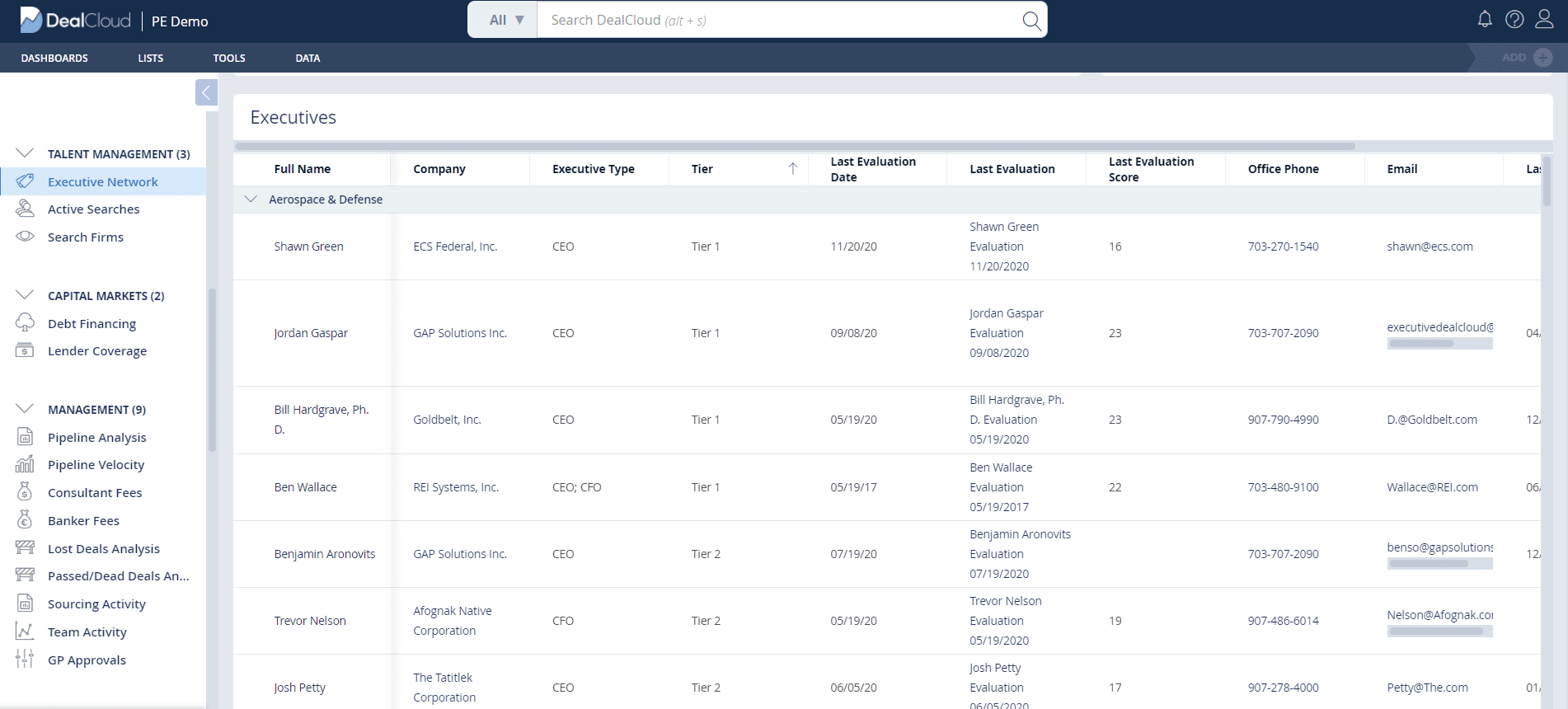

Organize and maintain the talent pool

As private equity firms constantly make new investments, they need to maintain an active watch on top-tier talent. With DealCloud, private equity decision-makers use data from PitchBook, Preqin, and FactSet to find and save executive talent information. Users can search for executive information using various criteria such as name, company, type, tier, and last evaluation. Additionally, they can keep track of the deals that executives are being considered for.

DealCloud helps capital markets professionals connect new executives with coaches, consultants, and advisors, and track their communication.

Learn more about the Intapp DealCloud platform and its executive talent management capabilities.