Corporate development teams are often limited in resources and support, yet they’re responsible for meeting huge targets while managing multiple day-to-day business development tasks. Simultaneously, these teams must track emerging industry trends, source strategic acquisition opportunities, maintain visibility on both new market entrants and competitors, construct target lists, and quickly identify the right acquisitions and executives to compete in today’s fast-moving market. Without proper corporate development strategy and technology support, corporate development teams can quickly become overwhelmed.

In this article, we’ll highlight how Intapp DealCloud’s purpose-built corporate development technology can help your team:

- Better visualize pipeline.

- Improve the decision-making process.

- Automate internal workflows.

Better visualize your pipeline with custom-built charts and dashboards

In today’s fast-paced, always-evolving deal environment, corporate development teams need to maintain a high degree of visibility. When new opportunities arise, team members must have the agility to act on them, as well as the ability to quickly communicate their corporate development strategy to intermediaries, consultants, and their network of business owners and executives. DealCloud acts as a single source of truth that gives these teams a comprehensive view of their pipeline.

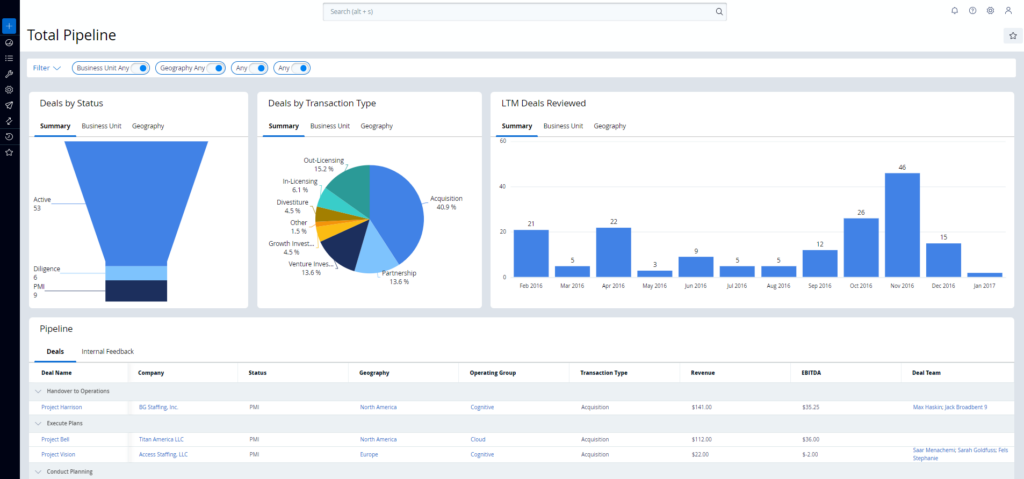

With DealCloud, corporate development teams can leverage pre-filtered, customized dashboards that make it simple and easy to consume data. The pipeline dashboard helps corporate development teams visualize the overall pipeline at a glance, letting them quickly view every deal by status, geography, business unit, transaction type, known performance metrics, and public financial records.

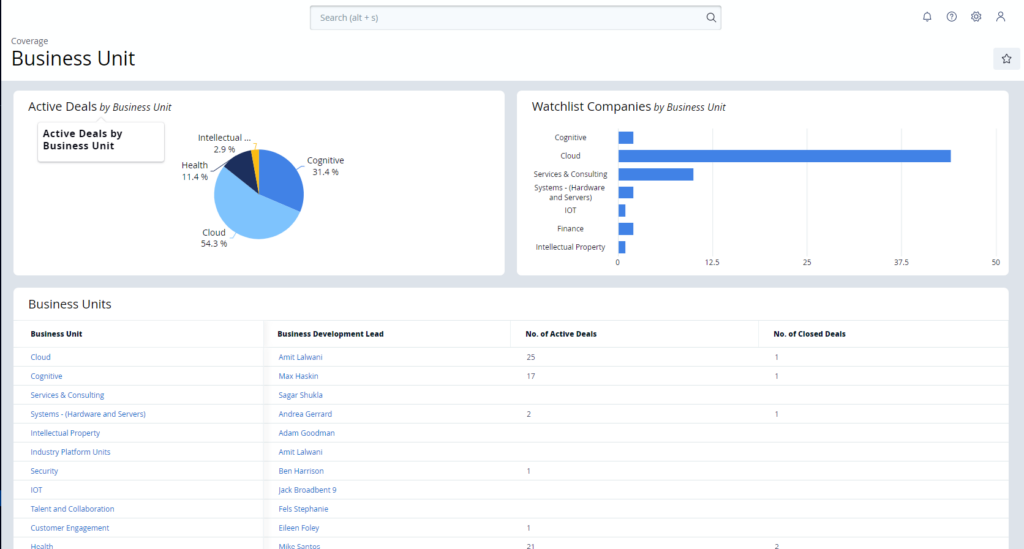

The business unit dashboard helps the team further analyze the corporation’s existing business unit coverage by identifying active and closed deals as well as the respective business development lead. As team leads seek updates on business units with the greatest growth potential, corporate development teams can generate reports on the latest add-on and roll-up activity as well as new opportunities from one centralized and up-to-date dashboard.

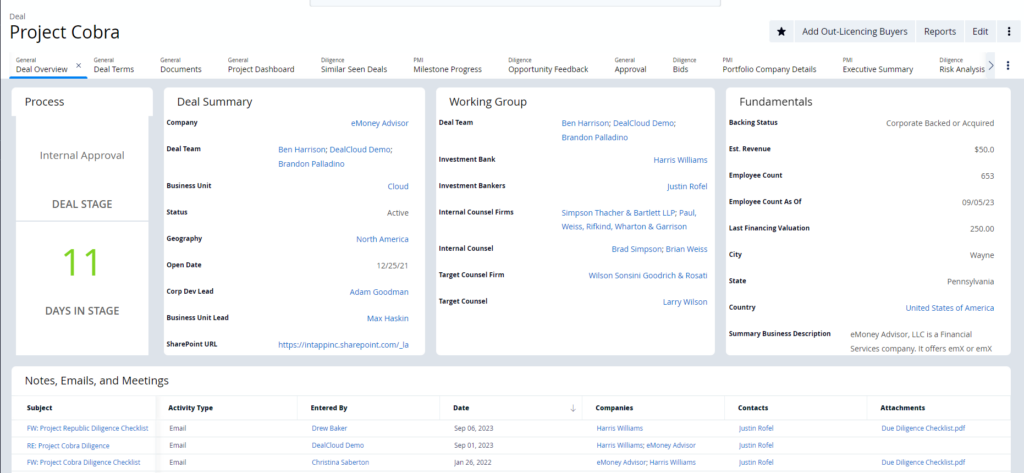

Corporate development professionals can click on a specific acquisition and access data about past communications, upcoming dates, executive contacts, and more to gain the clarity and information needed to stay up to date. Dealmakers, corporate leaders, and even board members won’t waste time asking colleagues for updates or combing through emails for details – instead, they can leverage DealCloud to access everything they need.

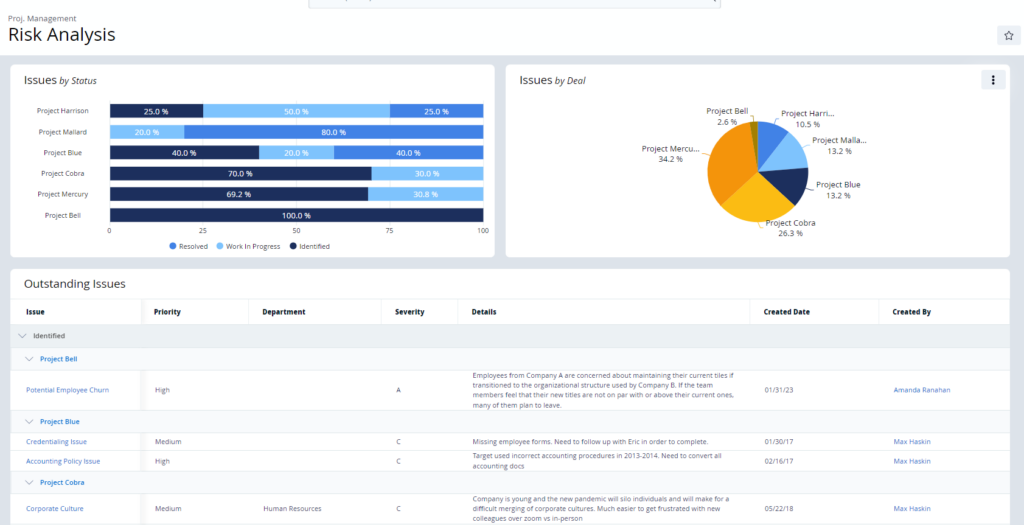

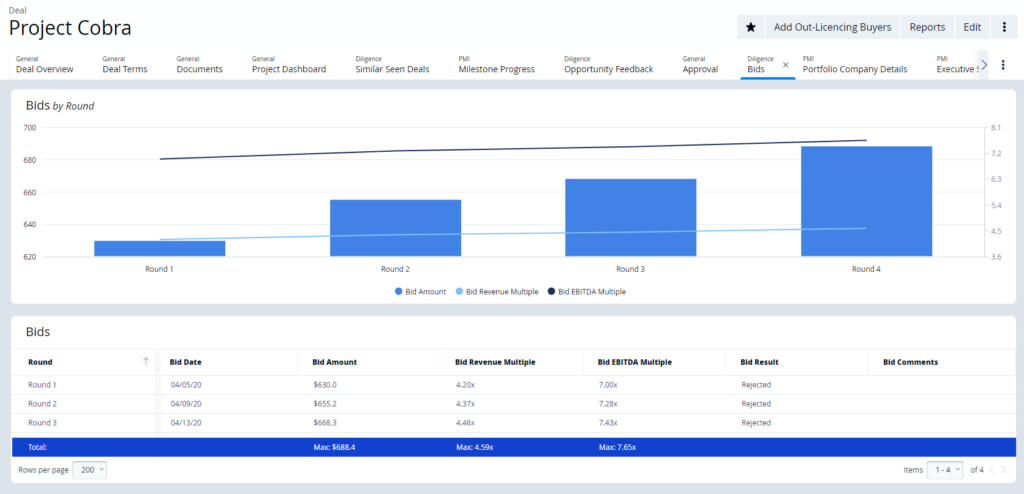

DealCloud serves as a centralized repository for acquisition leads, letting professionals view potential risks as well as the bid history on new opportunities. With the risk analysis dashboard, corporate development teams can identify associated project risks by listing the issue, risk priority, status, details, and, if applicable, risk resolution. For publicly traded corporate acquirers, monitoring and managing the risk profile associated with potential transactions is a critical task.

The bids page lets professionals see previous bids on opportunities, along with details such as the date, amount, revenue multiple, EBITDA multiple, result, and internal comments. As corporate development teams encounter similar companies, they can leverage historical bid data to better compete on potential acquisitions and improve their overall corporate development strategy.

Use data to evaluate new opportunities

Assessing the potential value of a corporate development opportunity — as well as gauging the strategic and organizational fit between the acquirer and its target — requires a deep level of industry and market understanding.

Proprietary and third-party data can help professionals make better-informed decisions on their corporate development strategies that lead to a higher degree of acquisition success. DataCortex provides an integrated data solution that lets dealmakers manage proprietary and third-party private company data from providers like PrivCo, SourceScrub, Factset, S&P Global Market Intelligence, Preqin, and Pitchbook in one unified platform.

Because DataCortex is fully integrated in DealCloud’s platform, professionals can easily run complex reports, analyze industry trends, and evaluate opportunities as well as originate and manage transactions. DataCortex lets professionals search third-party data sets — including high-quality private and public company data — directly within the DealCloud platform, eliminating the need to toggle between platforms.

Automate the internal approval process

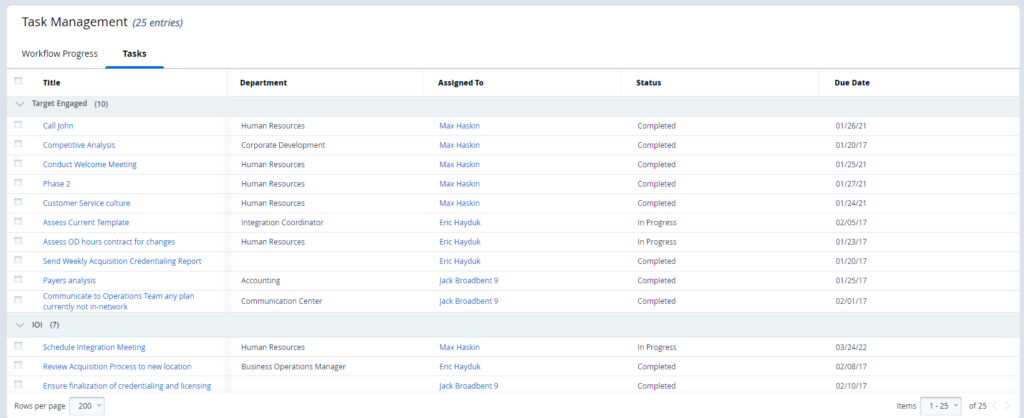

To remain competitive, corporate development professionals need to streamline the administrative burden of keeping track of a deal’s status and action items.

Despite a clear investment thesis and strategy, teams still need to seek internal approval from initiative sponsors. DealCloud enables team members to create and send forms to deal sponsors, then automatically collects and compiles their answers in real time on the deal page. Dealmakers can leverage event-triggered notifications to automatically alert team members that they need to review or complete such task.

All members with access can go to the deal page at any time to review inputs from other users. With this workflow automation, dealmakers can spend their time more effectively instead of tracking down information or team members.

Prioritize your corporate development strategy and potential acquisitions

The corporate development deal process requires professionals to wear many hats in the transaction, maintain a high level of focus, and quickly access both proprietary insights and new market data.

DealCloud provides corporate development teams with a central database that enables professionals to efficiently manage all aspects of their pipeline. Schedule a demo to see how you can transform your corporate development strategy process with Intapp DealCloud’s purpose-built technology.